Energy giants demand billions from Dutch taxpayers for stranded coal assets.

New research undermines compensation claims for coal phaseout.

Coal assets held by RWE and Uniper in the Netherlands are already economically unviable and have largely been written-down, according to a new analysis by IEEFA and Ember (an independent energy and climate think tank), in collaboration with Dutch knowledge centre SOMO. Market forces, not Dutch legislation, are causing the demise of these coal-fired power plants.

Highlights

- German utilities RWE and Uniper (owned by Fortum in Finland) are suing the Netherlands under the Energy Charter Treaty (ECT) for phasing out coal-fired power generation by 2030.

- RWE is seeking €1.4 billion in compensation for incurred damages, saying it can no longer run its Eemshaven power plant profitably after 2030. Uniper is seeking compensation between €850 million and €1 billion for its Maasvlakte 3 plant.

- Power producer Riverstone is also negotiating with the Dutch government over compensation for the closure of its plant.

- Market forces have rendered these coal plants economically unviable. The owners were making huge impairments on them from as early as 2013. This is due in large part to the uncompetitive economics of coal-fired generation, driven by a rising carbon price and cheaper generation from renewables and gas plants.

- The ECT is impeding EU coal phaseout strategies and creating a barrier to achieving emissions reduction targets by empowering foreign investors to sue countries for losses they deem caused by climate legislation.

- Taxpayer money spent on payouts could instead be used to support a just green transition.

Our research finds that the energy companies made poor, short-sighted investment decisions when they opened brand new coal-fired plants in 2015 and 2016. At this time, the market conditions for coal electricity generation were in rapid decline.

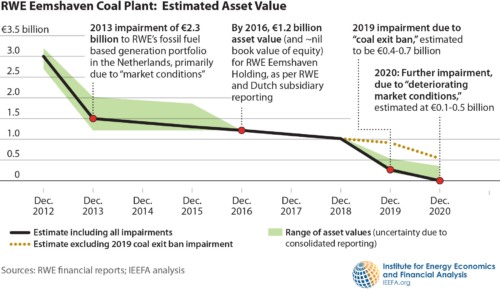

Based on RWE’s own financial reporting since 2010, our analysis shows how RWE’s €3 billion investment in its Eemshaven power plant, originally designed to run for 30-40 years, had collapsed to zero value just 5 years after it entered into service. Less than €700 million of that reduction can be explicitly attributed to the Dutch coal phaseout law, compared to the €1.4 billion in damages that RWE is seeking.

Ahead of proposed closures dates, these coal assets are already in decline. The electricity generation at all three power plants has dropped significantly from 2018 levels. RWE’s Eemshaven and Uniper’s Maasvlakte 3 average annual load factors more than halved from 73% in 2018 to 34% in 2020. Profits also tumbled in the same period from +€150 million to -€52 million. Riverstone’s Maasvlakte plant has been offline since a technical failure in January 2020, bleeding money due to fixed costs.

There is an even poorer outlook for profitability going forward. Our findings suggest that total net losses could already amount to at least €470 million by 2030 for all three plants. The ECT enables these energy companies to sue for loss of potential future earnings beyond 2030. The compensation claims overlook the fact that these supposed future profits are infeasible by 2030 and beyond.

Arjun Flora (aflora@ieefa.org) is IEEFA’s director, finance studies Europe.

Sarah Brown (sarah@ember-climate.org) is Senior Electricity Analyst – Europe, Ember

28 April 2021

IEEFA/EMBER