Can microgrids really bring power to the last billion?

When Hurricane Maria tore through the tropics in September 2017, it took Puerto Rico’s power system with it. Winds of 170 miles per hour(274 km/h) ripped down poles, transmissions lines, and transformers, leaving a tangled mess in America’s territory in the Caribbean. For weeks, 1.5 million people were without power. Thousands eventually died from the disaster, according to a study commissioned by the Puerto Rican government, and the island is still rebuilding.

One of the hardest-hit areas was the small island of Vieques. Sitting a few miles off the Puerto Rico mainland, the island’s power was lost after the storm severed an undersea cable. Despite the Federal Emergency Management Agency rushing diesel generators to the island, Vieques languished for months with only intermittent electricity and sporadic supplies.

But a new grid began rising from the ruins. Government agencies, relief groups, and private firms such as Tesla and Sunrun installed solar panels and batteries alongside generators, and restrung transmission lines. For Vieques, the re-energized grid came back online without ever connecting to the mainland. It may never reconnect again.

The government plans to make Vieques a case study and favors microgrids, said Omar Marrero, director of Puerto Rico’s Public-Private Partnership Authority, during an interview with Quartz last year. “Whatever the generation [source], we all agree on microgrids.”

After decades of decay that left the island’s transmission system “brittle,” with ongoing outages and billions in deferred maintenance, Puerto Rico is going to rebuild a new kind of grid based on a more resilient, cleaner model. The island passed a law in March to hit 100% renewable energy by 2050, and swiftly connect new sources of clean energy and microgrids to the main power system.

Vieques’s self-contained grid is likely to be the first of the major microgrids in Puerto Rico that will connect homes, businesses, and power sources. The system will run primarily off a combination of solar panels and batteries, and rely on generators for backup. Should a storm like Hurricane Maria hit again, disruption should be minimal. The island utility’s new CEO, Walter Higgins, told Bloomberg Environment that the island could serve as “a model literally for the United States and the world of microgrids that are distributed, resilient, and renewable and depend on only renewable resources for the most time.”

Puerto Rico’s embrace of microgrids hints at a different energy future. Some of the 1 billion people (pdf) around the world without electricity may finally get it without ever needing a central power grid. While microgrids have given industrialized countries a way to increase resiliency and bring more renewable power sources online, they’re enabling regions without power to leapfrog the 20th-century electrical grid.

What is a microgrid?

In its simplest form, a microgrid (pdf) is a small network of energy users and energy producers (power plants). In today’s power system, the grid radiates out in a hub-and-spoke model. At the center stands a big power plant (usually powered by fossil fuel). On the edges are homes and business consuming power.

In a microgrid, this system is distributed. Power moves between multiple nodes in the network. Supply and demand are balanced locally in real time. Solar power means homes and buildings generate their own energy. Batteries keep surplus supply close to its final destination, reducing the need for hefty transmission lines.

A few hundred or thousand customers can then operate independently of the centralized power grid, or integrate with it so that it can absorb energy from renewable sources such as wind and solar. It’s all coordinated through sophisticated software that automatically balances supply and demand within the network. “In the future, the grid looks less like broadcast [television] and more like the internet,” says Haresh Kamath of the Electric Power Research Institute.

Yet turning a profit in the real world is harder than it looks. In relatively well-off countries and major cities, billions in public investment have made power extremely cheap for customers. “[Electricity] is one of the most inexpensive commodities in the world,” says David Chiesa of S&C Electric, an equipment supplier for electric power systems. Some countries even deliver it for less than the cost of generation (without accounting for the high cost of pollution and global warming). Globally, prices range (pdf) from .06 cents per kWh in Saudi Arabia to 12 cents in the US and 38 cents in Germany. An average US homeowner spends about $100 per month on electricity.

“The business case is still very difficult for microgrids,” says Chiesa. “It’s still not below the price of grid power, with a few exceptions.”

That’s made microgrids a tough sell. Yet a few things are moving in favor of them. First, infrastructure prices are falling for batteries and distributed solar generation. Secondly, the cost to maintain and expand traditional power grids is ballooning, even as the damages from outages and mishaps keeps growing (California’s Pacific Gas & Electric recently filed for bankruptcy after its transmission lines appeared to spark fires costing $30 billion in damages). Finally, distributed renewable energy sources and storage have begun to make the traditional hub-and-spoke architecture less attractive compared to alternatives.

Take Hawaii and Puerto Rico. Both islands have high electricity prices and plentiful wind and solar resources. Homes or businesses can generate power on the cheap, and plug them into microgrids that bypass expensive (Hawaii) or unreliable (Puerto Rico) infrastructure. In Puerto Rico, for example, Siemens says it can build an enhanced mini-grid system (mini-grids are essentially larger microgrids covering tens or hundreds of thousands of customers) for just 7% more than a traditional system, while delivering far greater efficiency, reliability, and lower emissions. After including the price of outages, such as those following Hurricane Maria, the system is less expensive. Siemens is now proposing a series of 10 “mini-grids” to service the island. These resilient electricity “islands” can operate independently during an outage, or connect to the larger grid when desirable.

Will developing countries go first?

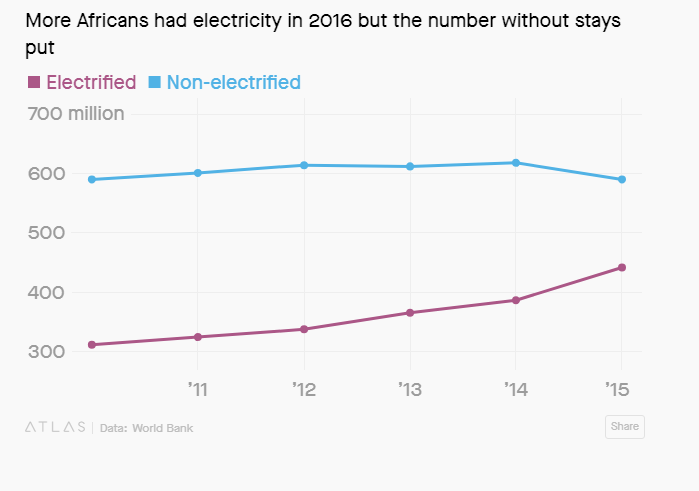

We may see the most rapid deployment in poor countries. Their lack of investment in power infrastructure changes the economics. While much of the industrialized world finished electrification by the 1950s, the grid has yet to reach 14% of the world’s population, reports Bloomberg New Energy Finance (BNEF). At today’s pace of electrification, 700 million people will be still be without power by 2030. But yesterday’s infrastructure isn’t needed to deliver today’s electricity.

In sub-Saharan Africa, more people have mobile phone subscriptions (700 million) than access to reliable electricity (about 450 million). That’s because wireless telecommunication allowed countries to skip over expensive 19th-century architecture in favor of 21st-century cellular towers and cheap handsets. Distributed power systems may do the same for electricity.

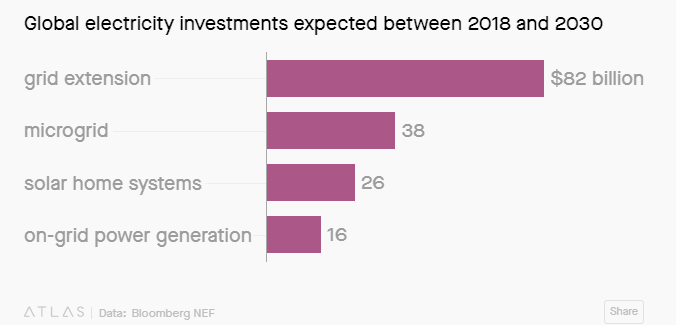

With the main grid years or even decades away from reaching far-flung settlements, microgrids close the gap. The price of microgrid electricity even beats out centralized grid sources when accounting for the cost of customer hookups (anywhere from $266 to $2,100 per connection, estimates BNEF’s Itamar Orlandi). Decentralized systems powered by solar photovoltaic (and sometimes batteries) will be the lowest-cost option for 300 million people, or 75% of the new connections needed to deliver power to everyone in sub-Saharan Africa, estimates the International Energy Agency. Most will be either mini-grid or individualized off-grid systems powered by solar panels.

Ultimately, microgrids could bridge the gap between centralized utilities and individual solar installations. Remote towns can build microgrids far faster than a utility will even reach them. Once it does, then microgrids (and individual homes) can be integrated into the centralized system, while retaining their independence during outages.

Getting to scale

Now we just need to see them operate at scale. Dozens of small examples exist around the world, from Japan to Italy to India, combining solar panels, natural gas and diesel generators, and battery storage. Smaller-scale projects, such as schools and community centers, are online. US firms Sunrun and Sunova are busy installing home solar and battery residential power systems that, one day, could connect to neighborhood microgrids with smart software.

Utilities are also embracing “non-wire alternatives” to traditional transmission and distribution infrastructure. Historically, grid operators built new lines well ahead of expected power needs (an expensive and sometimes unnecessary approach since growth forecasts are often inaccurate). A more efficient approach combines microgrids with energy efficiency, demand response, and batteries to expand the grid for peak load, and avoid replacing components as they age. Utility commissions are working on new ways to finance, and incentivize, grid operators to do this.

But experiences in countries such as India show how difficult this can be when things don’t line up. In a study entitled “How Weak Incentives Can Undermine Smart Technology,” researchers at the University of California, Berkeley studied how one of the most promising solar microgrid installers in rural India, Gram Power, stumbled despite doing everything right according to the experts. After visiting 176 villages between 2010 and 2015, the company had installed only 10 microgrids. Costs to acquire customers and maintain the system were higher than expected. Theft, and company agents’ reluctance to crack down on customers (usually their own neighbors), made it hard to collect revenue.

Experiences like this have made India rethink its rural electrification strategy (pdf) to emphasize more private home solar systems to avoid such problems. The lesson from Gram Power is that microgrids are not a silver bullet. Even when benefits outweigh the costs, all electrification strategies, like politics, are local. Making the electrons flow where they need to be is not enough. Incentives matter as much as technology.

4 May 2019

![]()