Cows Join Carbon Market in Quest to Curb Planet-Warming Burps.

Livestock that produce less methane have joined trees, wind turbines and cleaner cookstoves as the basis for carbon offsets.

A European startup has started selling carbon credits for cattle raised on a feed supplement that reduces the amount of heat-trapping greenhouse gas they release.

Mootral, based in Switzerland and the U.K., says its garlic-and-citrus feed can cut methane emissions from livestock by an average of 30%. Under its offset program, a certified farmer that’s produced milk using Mootral’s supplement can sell credits equal to one ton of carbon dioxide to customers that want to offset their pollution.

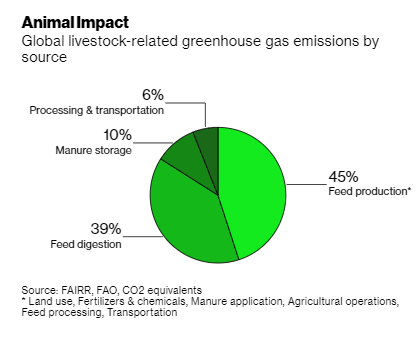

Livestock farming accounts for about 15% of global greenhouse gas emissions, largely from cows, sheep and other ruminants that emit methane, a gas that’s more than 80 times more potent than CO₂. Agriculture is making inroads into the $320-million voluntary carbon market, particularly through more environmentally friendly farming, though demand has so far been limited.

Mootral is trying to change that with its offsets, called CowCredits. Buying from Mootral will help companies diversify their basket of carbon solutions, Chief Executive Officer Thomas Hafner said in an interview. At 70 euros ($84) a ton, they’re several times more expensive than offsets based on planting trees, which have often failed to live up to their climate promises.

Hafner is also betting that countries will start taking methane pollution more seriously. “Governments are going to demand methane reducers as they become available in cattle and we’re going to be one of the players that will serve the market,” he said.

There are several challenges to Mootral’s approach. It’s difficult to obtain a universal, precise measurement of how much methane is being reduced by the company’s feed supplement. Mootral says it calculated the carbon savings based on cows at the Brades Farm in Lancashire, England which sells premium barista milk to coffee shops including Gail’s Ltd. Its offsets are verified by nonprofit Verra.

But methane emissions can vary depending on the cow’s breed and its environment. In the next two years, Mootral plans to conduct 40 studies in different parts of the world to measure the supplement’s impact in specific locations in order to take the initiative global and generate more CowCredits.

The company isn’t the only one marketing pollution-cutting feed additives, and major meat purchasers can set up their own bespoke arrangements with suppliers to cut emissions.

Nestle SA and Barry Callebaut AG have partnered with U.S. dairy farmers to use a feed additive that cuts methane emissions from cattle. Fonterra Co-operative Group Ltd., one of the biggest dairy producers in the world, has partnered with Royal DSM to speed up the deployment of Bovaer feed additive in New Zealand. Selected Burger King restaurants started selling Whoppers sourced from cows that are supposed to belch out less methane thanks to feeding on lemongrass.

“Reducing methane emissions from livestock is critical to decarbonizing agriculture,” said Dan Blaustein-Rejto, director of food and agriculture at environmental research organization Breakthrough Institute. While he expects feed additives to be central to companies’ plans to go carbon neutral, he sees difficulties in deploying them, particularly on grazing cattle, which cuts their impact.

And because feed supplements don’t fully eliminate methane emissions, more solutions will be needed to reduce the climate impact of eating meat. Switching to plant-based diets remains the most effective solution, at least until startups producing cultivated meat reach the scale that allows mass consumption.

So far Mootral has generated just over 300 CowCredits, selling them to companies such as U.S. coffee chains and a dietary supplement producer. It wants to create 20,000 to 50,000 credits in a year and is raising funds to scale up the rollout. It’s now focused on U.K. dairy farmers and is trialing the product on farms in the U.S. and Europe to create “climate-friendly” beef.

It estimates that its arrangement allows farmer to recoup the costs of purchasing the feed additive by either selling the credit or by selling their produce at a premium. “The whole thing is predicated on that farmers believe there will be uptake for premium produce and that retailers or restaurant chains or even dairy brands believe there is supply and there is uptake from their customers,” Hafner said.

— With assistance by Will Mathis, and Akshat Rathi

(Updates with analyst comment in 10th paragraph.)

14 April 2021

Bloomberg Green