EU solar demand to reach 30 GW in 2022

According to a new report from Agora Energiewende and Sandbag, the EU solar market grew around 60%, or 10 GW, last year. The analysis also predicts that total solar demand across all EU PV markets will continue to grow due to lower module prices, and that it may reach an annual volume of 30 GW within four years. Meanwhile, solar has reportedly achieved a 4% share in the EU electricity mix.

![]()

Solar demand across all EU energy markets grew by 60% to around 10 GW last year, according to the annual evaluation of the EU electricity system for 2018, carried out by think tanks Agora Energiewende, based in Germany, and Sandbag from the United Kingdom.

Despite the positive news, the report’s authors note, “… the EU only has a share of less than ten percent of the solar world market, which last year comprised 109 gigawatts.”

According to the analysis, solar’s current growth trajectory is set to continue over the coming years, with lower module prices driving demand. In 2018, prices in the EU were found to have dropped by around 29%. The report’s authors say that in the year 2022, annual EU solar demand could reach 30 GW.

Solar’s share

Overall, solar is said to have comprised 4% of the EU’s electricity mix last year, with Italy and Greece taking the highest share in their respective power systems with a percentage of around 9% and 7%, respectively.

Ireland, Finland, Poland, Sweden, Croatia and Hungary were found to have the lowest levels of solar development, each with under a 1% share.

“The EU so far largely missed the opportunity to profit from the very favourable solar module prices, which mean that solar power from new plants is now often cheaper than electricity from conventional power plants,” says Agora Energiewende analyst, Matthias Buck.

The bigger picture

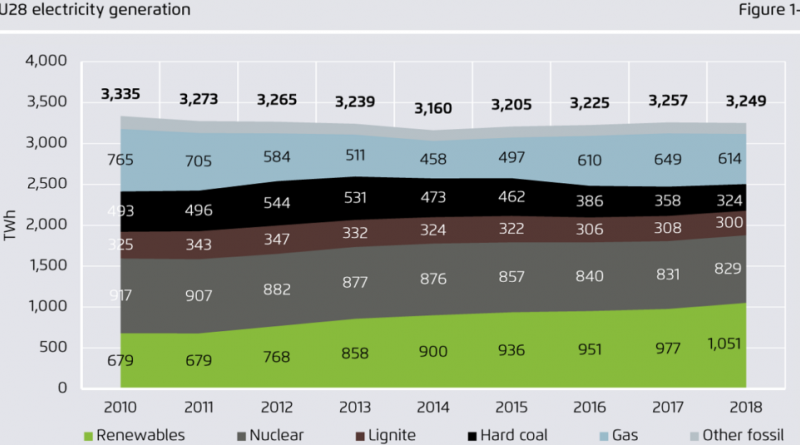

As for renewables as a whole, their share in the EU electricity system grew by around 2% to 32.3% in 2018, as a result of larger volumes of deployed solar, wind and biomass plants.

This development, according to the report, has displaced hard coal power production, particularly in Germany, the United Kingdom and France; while increased production from hydropower sources has helped reduce gas consumption. “Consequently, EU total coal generation fell by 6 percent in 2018 and was 30 percent below 2012’s generation,” the report reads.

The authors of the analysis also claim that if the EU wants to achieve its 2030 target of covering around 32% of its energy demand with renewables, their share in the electricity sector must reach 57%, given that the largest amount of the electricity needed to electrify the transport system and buildings via electric vehicles and electric heating will be provided by wind and solar.

Coal and gas, continues the report, are currently the main culprits behind the recent increase in power prices in the EU market, with the price of coal increasing by 15% last year, while gas prices rose 30%. “Consequently, wholesale electricity prices rose to 45–60 Euros per Megawatt hour through Europe. This is the level at which the latest wind and solar auctions cleared in Germany,” the two think tanks concludes.

30 January 2019

Emiliano Bellini

![]()