As fossil fuel prices skyrocket globally, renewables grow steadily cheaper

Stability of renewables an antidote to the volatility of gas and coal

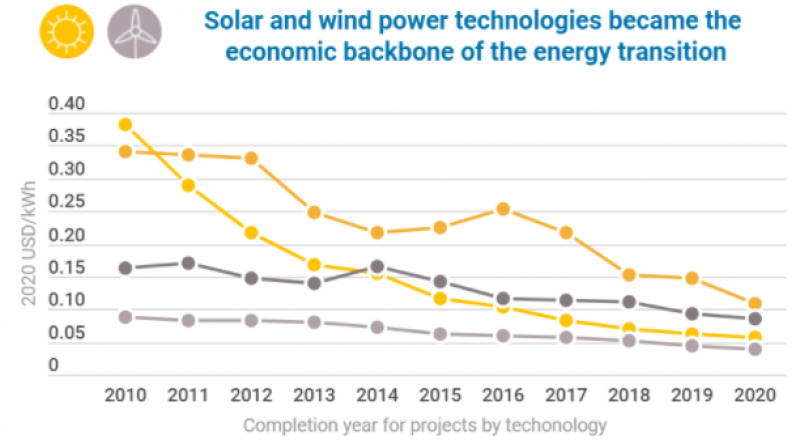

While volatile energy commodity prices have been sharply increasing globally, renewable technologies have been steadily decreasing. Over the last decade, the cost of electricity from utility-scale solar PV has fallen by 85 percent, concentrating solar power (CSP) by 68 percent, onshore wind by 56 percent and 48 percent for offshore wind, according to the International Renewable Energy Agency (IRENA).

Renewable Power Generation Costs (2020 USD/KWh)

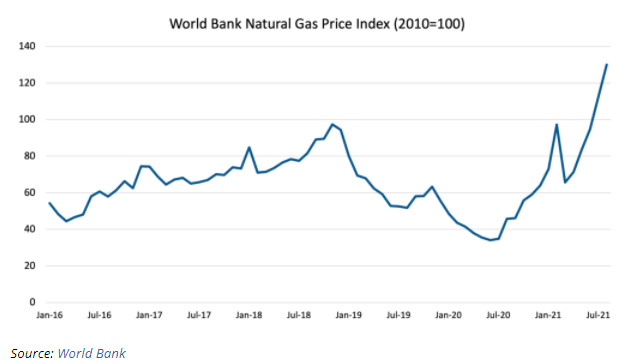

In contrast to this steady decline in renewable energy generation costs, prices of natural gas and coal have sharply increased, up to around 20 percent and 13 percent respectively, over the last three months. Additionally, electricity prices in Spain and other countries in August this year increased to three times higher than prices in the same month last year.

The recent increase in gas prices in Europe is a combination of several factors: Increased gas demand due to the economy rebounding from the pandemic-related recession, reduced gas supply from Russia and other contributors, such as low storage levels, extreme weather, and carbon pricing, among others. These point to how volatile and unpredictable the industry is. Globally, there are many factors that are affecting demand, supply and prices.

In terms of average monthly prices for natural gas, Europe has seen the highest prices compared to the U.S. and Japan at US$15.49 per million British thermal unit (mmbtu) in August 2021, while spot prices for liquefied natural gas (LNG) in Asia are trading at near-record levels for this time of year at almost $US25/mmbtu in recent days. In today’s market, more LNG contracts have prices linked to gas spot prices rather than oil-linked.

The law of supply and demand plays a vital role in the gas industry. Low gas prices are due to oversupply and this affects the profitability of gas exports. If demand is high, however, prices will go up and renewables will become more competitive.

Higher natural gas prices have contributed to a rise in coal consumption in some countries where it was decided to switch to coal‑fired power plants. As a consequence, carbon dioxide emissions have increased, as reported by the U.S. Energy Information Administration. This situation has influenced the continuous increase in coal prices during the last three months both in Australia as in South Africa. Australia’s coal had a peak in price of 168.8 $/mt in August 2021. Coal prices are expected to hit new highs during the month of September as thermal power plants across Asia are forecasting strong power generation consumption.

The fossil fuel sector is becoming more volatile and riskier. “Global investors are accelerating their collective move away from the massive climate-related risks associated with fossil fuel assets and building capacity so as to increasingly deploy huge amounts of capital into renewable energy infrastructure projects,” says Tim Buckley, co-author of a recent IEEFA report on global investments in renewable energy.

The summer months have affected electricity demand in southern and southeastern Europe due to the increase in economic activities, tourism and use of air conditioning, among other factors. Wind generation has been below-average keeping demand for gas high in the power sector.

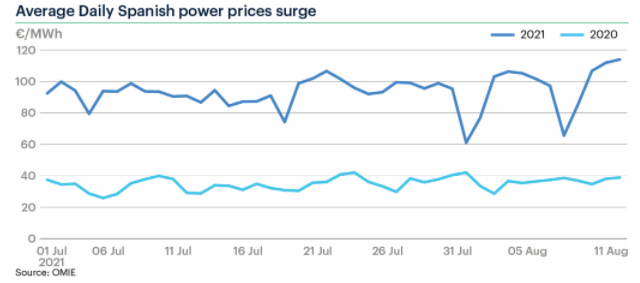

The increase in electricity demand and the rise in gas, coal, and carbon prices have resulted in climbing power prices. Spain has been affected by the hot summer months with an increase in the average daily spot price in July hitting €93.50 per megawatt hour (MWh), three times higher than in the same month last year.

Average daily Spanish power prices have been very volatile, ranging from 60 €/MWh at the end of July 2021 to around 110 €/MWh middle of August.

Due to high electricity prices, European countries like Spain have felt the need to increase renewable power generation from solar and wind.

Even before the escalation in gas, coal and electricity prices, IEEFA had reported that Spain had one of the highest gas tariffs in Europe mainly due to the regulatory framework that allows over-investment in infrastructure and consequently low utilisation rates.

The big question now is how the energy sector is going to react in the coming months and years. With more worldwide renewable generation, will dependence on fossil fuel commodities be diminished?

Ana Maria Jaller-Makarewicz (ajallermakarewicz@ieefa.org) is an IEEFA energy analyst.

27 September 2021

IEEFA