Renewable Energy Economics to Bring Disruption in 2020s.

Related Fitch Ratings Content: ESG in Credit – Energy and Fuel Management Issues

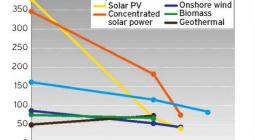

Fitch Ratings-London-20 April 2021: Falling unit costs of solar and wind energy will prove increasingly disruptive to the energy sector as a whole, according to a new report by Fitch Ratings.

One outcome of the pandemic has been greater use of renewable energy in many countries, as a result of falling demand overall and growing policy incentives for renewable deployment. Increasing economies of scale and technological maturity, as well as rising demand for power-purchase agreements, continue to attract investors to solar and wind projects. As renewables grow their share of generation, this is likely to lead to increased electricity price volatility, which is already challenging the viability of large fossil fuel and nuclear power projects in competitive markets.

Disconnect between supply and demand of renewable energy and intermittency of resources continue to pose challenges, with large-scale battery storage remaining prohibitively expensive in most cases. Grid-balancing and distribution costs are also set to rise as solar and wind are deployed more widely, and network utilities will be sharply increasing capital expenditure to meet these needs. Despite growing interest in the production of ‘green’ hydrogen from solar and wind, a near-term solution to the intermittency problem will be wider deployment of smart grids and intelligent pricing to balance supply and demand.

Despite some debate over the role of natural gas in low-carbon energy transition, many coal-dependent countries in Asia Pacific view gas an essential component of transition, and most gas applications in OECD countries are in heating of buildings and industrial processes, which will prove challenging to substitute. Ultimately, established economic structures, geography, climate and other regional characteristics will determine patterns of energy consumption and energy efficiency. Companies with geographical diversification will be better placed to absorb local increases in regulatory compliance costs or resource input costs.

20 April 2021

Fitch Ratings