Race to the bottom: the disastrous, blindfolded rush to mine the deep sea

One of the largest mining operations ever seen on Earth aims to despoil an ocean we are only barely beginning to understand.

Ashort bureaucratic note from a brutally degraded microstate in the South Pacific to a little-known institution in the Caribbean is about to change the world. Few people are aware of its potential consequences, but the impacts are certain to be far-reaching. The only question is whether that change will be to the detriment of the global environment or the benefit of international governance.

In late June, the island republic of Nauru informed the International Seabed Authority (ISA) based in Kingston, Jamaica of its intention to start mining the seabed in two years’ time via a subsidiary of a Canadian firm, The Metals Company (TMC, until recently known as DeepGreen). Innocuous as it sounds, this note was a starting gun for a resource race on the planet’s last vast frontier: the abyssal plains that stretch between continental shelves deep below the oceans.

In the three months since it was fired, the sound of that shot has reverberated through government offices, conservation movements and scientific academies, and is now starting to reach a wider public, who are asking how the fate of the greatest of global commons can be decided by a sponsorship deal between a tiny island and a multinational mining corporation.

The risks are enormous. Oversight is almost impossible. Regulators admit humanity knows more about deep space than the deep ocean. The technology is unproven. Scientists are not even sure what lives in those profound ecosystems. State governments have yet to agree on a rulebook on how deep oceans can be exploited. No national ballot has ever included a vote on excavating the seabed. Conservationists, including David Attenborough and Chris Packham, argue it is reckless to go ahead with so much uncertainty and such potential devastation ahead.

Louisa Casson, an oceans campaigner at Greenpeace International, says the two-year deadline is “really dangerous”. Given the potential risks of fisheries disturbance, water contamination, sound pollution and habitat destruction for dumbo octopuses, sea pangolins and other species, she says no new licences should be approved. “This is now a test of governments who claim to want to protect the oceans,” she said. “They simply cannot allow these reckless companies to rush headlong into a race to the bottom, where little-known ecosystems will be ploughed up for profit, and the risks and liabilities will be pushed on to small island nations. We need an urgent deep-sea mining moratorium to protect the oceans.”

Mining companies also insist on urgency – to start exploration. They say the minerals – copper, cobalt, nickel and manganese – are essential for a green transition. If the world wants to decarbonise and reach net-zero emissions by 2050, they say we must start extracting the resources for car batteries and wind turbines soon. They already have exploration permits for an expanse of international seabed as large as France and Germany combined, an area that is likely to expand rapidly. All they need now is a set of internationally agreed operating rules. The rulebook is being drawn up by the ISA, set up in 1994 by the United Nations to oversee sustainable seabed exploration for the benefit of all humanity. But progress is slower than mining companies and their investors would like.

That is why Nauru’s action is pivotal. By triggering the “two-year rule”, the island nation has in effect given regulators 24 months to finish the rulebook. At that point, it says TMC’s subsidiary Nauru Ocean Resources Inc (NORI), intends to apply for approval to begin mining in the Clarion-Clipperton zone, an expanse of the North Pacific between Hawaii and Mexico.

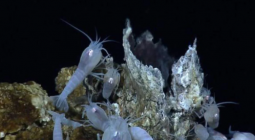

The deep ocean is the least known environment on Earth, a realm that still inspires awe and wonder. By one estimate, 90% of the species that researchers collect are new to science, including the pale “ghost” octopus that lays its eggs on sponge stalks anchored to manganese nodules or the single-celled, tennis-ball sized Xenophyophores. In the midnight, hadal and abyssal zones, fish and other creatures must make their own light. Biolumescent loosejaw and humpback blackdevils, a type of anglerfish, have evolved with in-built lanterns to seek out and draw in their prey. First-time human visitors often go expecting darkness and return filled with wonder at the undersea displays of living fireworks. Marine biologists believe there may be more bioluminescent creatures in the deep sea than there are species on land.

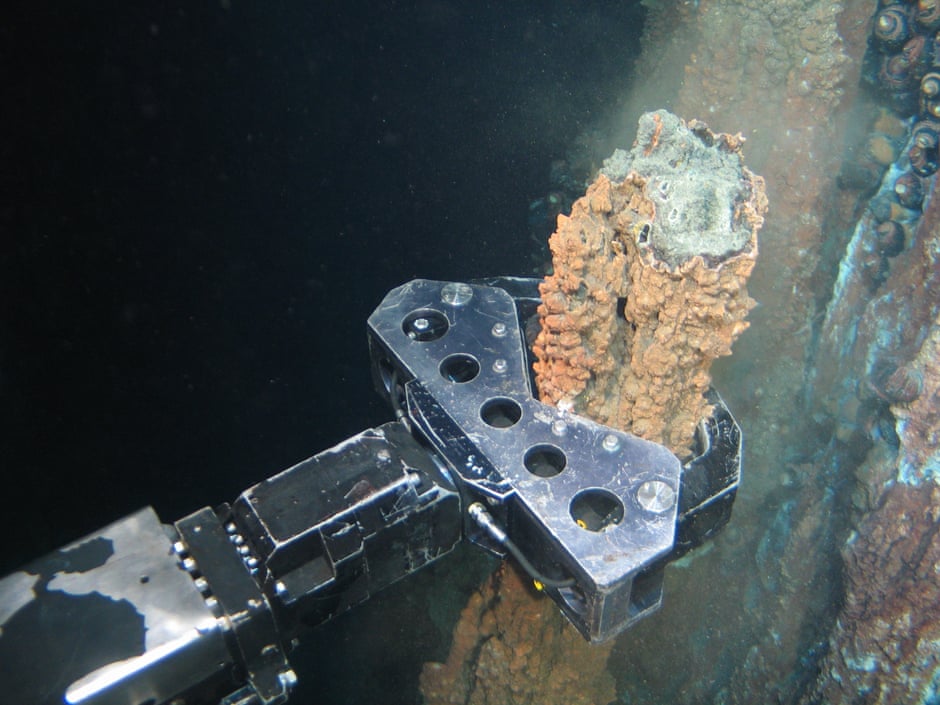

There is also thought to be a greater wealth of minerals such as copper, nickel, cobalt and rare earth elements such as yttrium, as well as substantial veins of gold, silver and platinum. Most are found near hydrothermal vents or in rock concretions known as polymetallic nodules that can be as big as a fist or as small as a fleck of skin. The challenge is gouging them out and lifting them up to the surface. When the first attempts were made to harvest nodules in the mid-1970s, the chief executive in charge of the operation exasperatedly described the task as like “standing on the top of the Empire State Building, trying to pick up small stones on the sidewalk using a long straw, at night”. Today’s technology has moved on, but scientists and conservationists doubt that it is ready and the environmental risks are fully understood. They would like more time. Nauru and TMC have given them less. The countdown clock now has 21 months left, and counting.

History does not offer much encouragement to the denizens of the deep that the issue will be resolved in their favour. Mining has provided the building blocks of civilisation. Without ore, humankind could not have had the iron age, the bronze age and certainly not the great cultures of ancient China, Nubia, Egypt, Greece, Rome, the Aztecs or Mayans. In modern times, particularly the great post-second world war acceleration of the past 70 years, more has probably been gouged from the Earth than in all of previous human history combined.

The materials for a built and manufactured environment are extracted at the expense of natural beauty, resilience and stability. For most of human history, this was considered a fair trade-off. The costs – cleared forests, scarred landscapes, polluted water, air filled with dust, carcinogens and greenhouse gases released into the atmosphere – were either unknown or deemed small compared with the gains. They rarely appeared on corporate or national balance sheets. Miners extracted oil, gas, coal, iron, gold, copper, lithium and other minerals, while leaving other species, remote communities and future generations to pay the price.

‘A throwback to the robber baron era’

Mining has often proved a trade based on imported resources and exported risk. In recent decades, this trade-off has come into question as scientific knowledge of the consequences has advanced. Environmental concerns have prompted calls for stricter regulation. But, oversight, if it exists at all, is often shaped by those who stand to benefit in the short term rather than those left to clean up the mess. And mines are moving further from power centres, which means less likelihood of Nimby protests, media coverage, challenges by conservationists or legal redress. Most of today’s mega-mines are in remote regions: the Carajás iron-ore complex and the Paragominas bauxite mine in the state of Pará, northern Brazil; the Oyu Tolgoi copper mine in Mongolia’s Gobi desert; Bingham Canyon copper mine in Utah’s Oquirrh Mountains; Chuquicamata copper mine in Chile’s Atacama desert; Mirny mine in Siberian Russia; or the many offshore oil and gas wells in the Gulf of Mexico, the North Sea, the Caribbean and elsewhere.

If mining in the deep ocean is technologically challenging and expensive, then independent oversight is even tougher: beyond all national jurisdictions, too expensive for environmental organisations to reach, too inaccessible for all but invited journalists to visit, and totally free of people so no chance of hold-ups by protesters. Fish, crustaceans and microbes might suffer, but they cannot complain.

Just like almost every other mining project in history, TMC and other mining companies promise to maintain the highest environmental standards, and to operate within guidelines laid out by regulatory bodies. And just like almost every other mining project in history, it is in their interest to exert pressure on those same regulatory bodies to ensure projects go ahead quickly with environmental standards that do not sink their bottom line.

Payal Sampat, mining programme director at the Earthworks environmental charity, said the rushed approach to deep-sea mining was reminiscent of the wild-west prospectors of the 19th century. “This really is a throwback to the early robber baron era. Our global heritage is being decided in small backroom discussions. Most people are completely unaware that this enormous planet-changing decision is being made. It is very non-transparent.” She said the mining industry had never been properly regulated. Today’s mega-pits are so big they can be seen from space, but they are governed by laws drawn up 150 years ago in the era of picks and shovels. “Deep-sea mining really represents a continuation of that destructive extractivist mindset. It is all about looking at the next frontier rather than using the resources we already have much better.”

The wasteland

Nauru ought to provide a salutary reminder of the destructive spiral that follows when an ecosystem is sucked dry. Once described as a Pacific idyll, the island’s topsoil was stripped of phosphate first by the British, then the Germans, then New Zealanders and Australians. They wanted the deposits to fertilise gardens and farmland in their own countries, and promised to restore the landscape and fully compensate those affected by environmental damage. By the time of independence in 1968, enough phosphate was left to briefly make the country’s 12,000 inhabitants the second-richest people on Earth. As phosphate prices rose from $10 a ton to more than $65 in the 1970s, gross domestic product per capita topped $50,000, second only to Saudi Arabia.

But within two decades, the resource was virtually exhausted, leaving an inland moonscape of gnarled, spiky rock and an economy in tatters. Restitution funds were supposed to rehabilitate 400 hectares (1,000 acres), but they have been frittered away in the past 25 years with barely six hectares recovered.

The gutting of the topsoil has caused unforeseen problems to the local climate, vegetation and society. Loss of vegetation has prevented rain clouds from forming over the island and led to more droughts. Several endemic plant species are now endangered and food production has been affected. Locals have turned from healthy local produce, such as coconuts, to fatty and salty tinned goods, resulting in one of the highest levels of obesity, heart disease and diabetes in the world. As one former finance minister put it: “Nauru was once a tropical paradise, a rainforest hung with fruits and flowers, vines and orchids. Now, thanks to human avarice … and short-sightedness, our island is mostly a wasteland.”

The 12,000 inhabitants have resisted repeated attempts to relocate them to an island off Queensland and looked for new ways to make a living. After the economy collapsed, the desperate government turned to offshore banking. But with customers that included the Russian mafia and al-Qaida, the US Treasury blacklisted the island as a centre of money laundering and corruption. After that failure, the microstate rented itself out to Australia as a detention centre for asylum seekers, a business that now provides more than half of the state revenue. When that declined, Nauru began to eye up the surrounding seabed by teaming up with TMC, which is paying tens of millions of dollars a year in royalties for its fully owned NORI subsidiary.

At the ISA, Nauru is supposed to be a sponsor nation for TMC. In reality, the island acts more like a client state for the corporation, and a company executive can behave as its spokesperson. In 2019, as chairman of DeepGreen Metals, Gerard Barron, was listed as a member of the Nauru delegation and spoke from the island’s seat in the plenary meeting.

Little wonder then that eyebrows were raised when this tiny nation, which constitutes just 0.00016% of the world’s population, took the initiative to open up the seabed. Few observers doubt that this was done at the behest of TMC.

Matthew Gianni, co-founder of the Deep Sea Conservation Coalition, said: “This is all about money – money for DeepGreen [TMC] and its shareholders and money for Nauru – and the fear that if DeepGreen doesn’t get a licence soon, investors will walk away from the company and both DeepGreen and Nauru will lose out on any revenue.” He said the case showed the need to shake up international governance. “The ISA’s decision-making process is seriously flawed and needs to be fixed.”

In lieu of comment, The Metals Company referred questions to three external experts that it said specialised in deep-sea ecosystems and plume dynamics.

TMC is among a cluster of mining companies that argue seabed minerals are essential if the world is to make the transition from fossil fuels to renewables. Barron, its chief executive and chairman, is fond of stating that a single 75kW electric vehicle battery requires 56kg of nickel and 7kg each of manganese and cobalt, plus 85kg of copper for the vehicle’s wiring. To convert the world’s 1bn-plus combustion-engine cars to electric would require far more metal than is currently produced on land. Barron says tapping seabed resources would still not close the supply gap, but that it could accelerate the transition, reduce mining emissions and provide revenue for poorer countries. As a sign of TMC’s commitment to the environment, he says the company would halt production after the world has enough minerals for 2bn batteries, because that would be enough to allow full recycling.

But many battery-makers and industrial users are lining up with the conservationists rather than the miners. In April, BMW, Volvo, Google and Samsung joined a World Wildlife Fund (WWF) call for a moratorium on seabed mining. Scientists and campaigners say TMC is creating a false sense of urgency about the need for deep-sea minerals. They say existing mineral supplies are sufficient for the coming 10 years and after that much of the demand could be met by fast-improving recycling technology. Others are sceptical about the promise of a 2bn battery cap. Lisa Levin, a professor of biological oceanography at Scripps Institution of Oceanography, said: “Once you start up a new industry it won’t just be DeepGreen [TMC], it will be multiple countries. It will be very hard to stop. Mining needs to continue for 20 or 30 years to recoup investment. It’s not something you put back in the box.”

Who are the ISA?

Many observers accept that deep-sea mining will go ahead at some point. But it needs to be done carefully, after the risks are fully assessed, the technology is perfected and oversight systems are made as robust as possible to ensure minimal impact on ocean ecosystems. The world might have more confidence that this was the case if the regulatory body was more open, more democratic, less focused on commercial gain and more attuned to environmental loss. As it is, however, the ISA is geared towards ploughing ahead.

It held its first meeting in Kingston, Jamaica, on 16-18 November 1994. The venue for this and subsequent gatherings was the Jamaica Conference Centre, which boasts of being “the Caribbean’s most sophisticated meeting place”. In the heat outside, angular concrete lines stand out between palm trees and fountains. Inside, the air-conditioned conference centre is decorated with bright hand-woven panels. This is a multinational world where you pay in dollars. ISA delegates roll up in diplomatic limousines, some with little flags on the bonnet, and congregate between meeting rooms, the marble lobby, and over cocktails in bars looking out across the Caribbean. In the evenings, delegates and contractors are invited to soirees hosted by the Jamaican government or dinner at the mansion of the ISA secretary general, Michael Lodge, high on the hill overlooking the harbour.

Lodge, a British lawyer, wants member states to agree on a rulebook that will set standards for mining practices and allow commercial operations to begin. Discussions on this topic have been under way since 2017, but have been snarled up over how to share future mining proceeds among nations. The ISA prefers to treat this as a technocratic problem. But, as the intervention of Nauru has shown, this is about much more fundamental issues of global governance and politics. Does the world want to be pushed into the final frontier of the global commons by a desperate microstate and a multinational mining company? Is it willing to take the risk that the ocean floor will end up like Nauru, a victim of over-exploitation and false promises of restoration?

Archive documents show corporations have tried to influence the ISA since its inception. In the 1980s, multinational corporations, such as Lockheed Martin and Sumitomo, were lobbying governments to ensure the UN Convention on the Law of the Sea “should contain a bias in favour of mining production”.

The UN general assembly subsequently approved the funding of the ISA in 1994, noting that the ocean floor and subsoil, beyond the limits of national jurisdiction, were the common heritage of humanity and should be dealt with in line with “the growing reliance on market principles”. Other species and ecosystems were an afterthought. To circumvent regulatory hold-ups, wealthy nations also pushed for a “two-year rule” that could be initiated by any country. Once that process begins, the onus shifts to the regulators to adopt exploitation regulations within 24 months.

In theory, every country in the world is involved in the ISA’s decision-making. In practice, power lies with a small group of experts that is weighted in favour of mining. There is no specialist environmental or science assessment group to vet applications for new contracts. Instead, new contracts are initially made by the ISA’s Legal and Technical Commission (LTC), which comprises just 30 members. Their decisions can only be overturned by a super-majority of two thirds of the full council, which comprises 36 states.

The commission has a 100% record of approving exploration applications, for which ISA charges a $500,000 (£365,000) processing fee. Membership of the LTC is skewed towards extraction rather than environmental oversight – a fifth of the members work directly for contractors with deep-sea mining projects. They include Nobuyuki Okamoto, who established Japan Oil, Gas and Metals National Corporation, which has started its own seafloor exploration, and Carsten Rühlemann, who works for Germany’s Federal Institute for Geosciences and Natural Resources, which holds exploration contracts in the Pacific and Indian Oceans. Many others have a background in mining or oil and gas exploration. Among them are the chair of the commission, Harald Brekke, who is a senior geologist at the Norwegian Petroleum Directorate; Pakistan’s representative, Khalid Mehmood Awan, who has worked for offshore oil and gas companies; and an Australian geologist, Mark Alcock, who is listed as working previously in surveying for petroleum and minerals exploration. By comparison, only three members are obviously focused on marine ecosystems, such as Gordon Lindsay Paterson, a zoologist at the Natural History Museum in London.

A spokesperson for the ISA said: “Members of the LTC are elected by the council from among the candidates nominated by states parties to UNCLOS [United Nations Convention on the Law of the Sea]. States parties shall nominate candidates of the highest standards of competence and integrity with qualifications in relevant fields. The council shall endeavour to ensure that the membership of the LTC reflects all appropriate qualifications. In the election of members of the LTC, due account shall be taken of the need for equitable geographical distribution and the representation of special interests.”

It added that 31 contracts for exploration had been granted so far and the “evaluation by the LTC of an application for a plan of work for exploration is a rigorous process”.

Some members of the LTC privately recognise the need for change, so the risks to this vast new area of exploration can be properly evaluated. “We probably know more about outer space than we do about this [deep-sea] frontier,” said a delegate who asked to remain anonymous. “I have heard suggestions for more environmental oversight, and I cannot say I have a contrary view.”

It is not just small island states that are complicit. Seabed resources are supposed to benefit all of humanity and promote sustainable development, but just three companies from wealthy nations have a hand in eight of the 10 contracts to explore for minerals in the Pacific’s Clarion-Clipperton zone that have been awarded since 2010: the Canadian-registered TMC (formerly DeepGreen), the Belgian corporation Dredging Environmental and Marine Engineering (DEME), and UK Seabed Resources, a subsidiary of the US arms manufacturer Lockheed Martin.

The role of these companies is opaque. None of the parent companies are included by the ISA in its list of contractors. A common practice is to operate through subsidiaries or by taking shares in partners in small island states, often in conjunction with national governments. This leads to concerns about accountability in the event of an accident: the subsidiaries are often small, which could leave poor nations with huge liabilities.

The British government has fudged its response to Nauru pulling the two-year trigger. This seems appropriate for a former colonial power that is still struggling to match its claims for environmental leadership with actions that run against its continued dependence on exploiting overseas resources. In 2019, the House of Commons environmental audit committee, including the Tory MP Zac Goldsmith, now Lord Goldsmith and minister for Pacific and the environment, concluded that deep-sea mining would have “catastrophic impacts on the seafloor”; that the ISA benefiting from revenues from issuing mining licenses was “a clear conflict of interest” and that the case for deep-sea mining had not yet been made.

However, ties between the UK government and the deep-sea mining industry have been unhealthily cosy. A Cabinet Office official has moved to Lockheed Martin, which owns UK Seabed Resources, to head their government affairs department. The former prime minister David Cameron used Lockheed Martin’s estimates of the potential value of the deep-sea mining industry, rather than independent analysis. When Greenpeace was finally granted a freedom of information request for the deep-sea mining licences between the British government and UK Seabed Resources, it found it was “riddled with errors and inaccuracies”, that it was based on outdated legislation and that it extended for a duration beyond the limits permitted by UK law.

When asked a parliamentary question about Nauru and the two-year trigger, the then business minister Nadhim Zahawi refused to support a moratorium and said the UK’s position was to wait for sufficient scientific evidence and strong environmental regulations. Zahawi has a deeper background in mineral exploration than any other MP. Before he joined the government, he received more than £1m in salary and bonuses from Gulf Keystone Petroleum, worked as a consultant for the Canadian oil firm Talisman and declared shares in the oil firm Genel Energy and Gulf Keystone. There is no suggestion of wrongdoing but – like many members of the LTC – he may be predisposed towards the extractive industries, having made a living from them for so many years.

Activists say it is not too late to stop the clock; opposition is gaining momentum. The world congress of the International Union for the Conservation of Nature earlier this month voted overwhelmingly to ban deep-sea mining. Support for the motion came from government delegates as well as civil society. Although the vote is non-binding, it highlights the broad unease at the shotgun tactics of Nauru and TMC. There are also plans for an appeal to another UN body, the International Tribunal for the Law of the Sea, against allowing deep-sea mining.

Our common heritage

Few countries are outright opposed to the mining, but many would prefer to wait. Their motives differ widely. On one side are nations such as Costa Rica, Fiji and Germany that are wary about the environmental implications. On the other are nations such as Chile and many African countries, with strong terrestrial mining interests, that do not want to see more competition that could drive down prices for their minerals. The African Group of nations has come out strongly against Nauru’s move, saying it is “likely to weaken rather than facilitate the development of an effective regime fully embodying the common heritage of mankind principle”.

Academics and civil society groups believe TMC has overplayed its hand. They hope its premature move to set a deadline will spur reforms of the ISA. Pradeep Singh, an ISA observer and ocean expert at the Institute for Advanced Sustainability Studies in Potsdam, Germany, said: “It does not say too much about the ISA decision-making process, to be honest, except that it is regrettable that the provision has been invoked. Perhaps the timing of the move to invoke the provision is less related to actually getting the process moving at the ISA but more related to increasing market confidence or value, and attracting investors to invest in the contractor.”

The case raises still deeper questions about humanity’s treatment of the Earth, particularly the dangerous gap between caring for our immediate local environment while turning a blind eye to what happens in the planet’s more remote corners. The French philosopher Bruno Latour traces this back to colonial thinking, which continues in present-day neoliberal capitalism. “Every state delineated by its borders is obliged, by definition, to lie about what allows it to exist since, if it is wealthy and developed, it has to expand over other territories on the quiet, though without seeing itself as being responsible for those territories in any way,” he writes in his new book After Lockdown: A Metamorphosis. “That’s a basic hypocrisy that creates a disconnect between, on the one hand, the world I live in as a citizen of a developed country, and, on the other, the world I live off, as a consumer of the same country. As if every state was coupled with a shadow state that never stopped haunting it, a doppelganger that provides for it on the one hand and is devoured by it, on the other.”

A pithier argument is made by Will McCallum, head of oceans at Greenpeace UK, who fears the deep sea will suffer like all other newly opened territories. “Any claim of not being environmentally damaging is meaningless, as we have no idea now what that environment is,” he said.

“We have never entered a frontier and not fucked it up more.”

The Guardian