Ernst & Young: Υποχώρησε στην 30η θέση η Ελλάδα στο Δείκτη Ελκυστικότητας για επενδύσεις ΑΠΕ

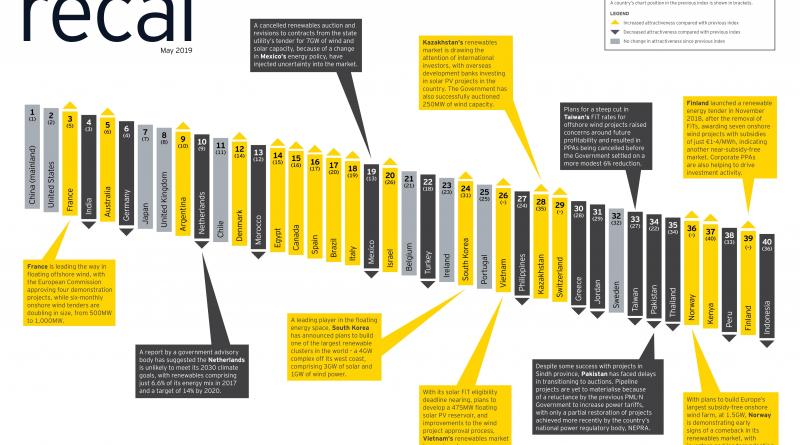

China and the US have maintained the top two places, respectively, in the EY Renewable Energy Country Attractiveness Index, with France moving up two places into third on the back of developments in floating offshore wind and bigger onshore targets.

The 53rd index sees India slip to fourth and Germany to sixth from fourth, with Australia moving up one place to fifth.

The UK remains in fifth place despite the recent offshore wind sector deal announcement.

The sector deal aims to deliver 30GW of offshore wind by 2030, compared with 8.2GW at the end of last year.

EY global power and utilities corporate finance leader and the index chief editor Ben Warren said: “While the offshore wind deal is extremely positive news for the UK renewables sector and will help to attract significant investment over the coming years, the announcement regrettably follows the withdrawal of support for onshore renewables in 2016 that has slowed UK sector growth.”

EY said that last year just 598MW of onshore wind was installed in the UK, down from 2.7GW in 2017, citing figures from trade body RenewableUK.

The lack of support for the Swansea tidal lagoon and changes to network charges – which have been favouring decentralised renewables, energy storage and demand-side response – will hamper investment in the sector in the UK going forward, EY added.

The company said that globally renewable energy is entering a new phase of subsidy free growth.

Warren said: “In this more complex subsidy-free environment, renewable developers must work harder and smarter to find the revenue certainty they need to finance or monetise their efforts.

“Europe has led the way with unsubsidised projects in areas with good renewable resources, and multiple projects across the Nordics, UK, and Spain are being developed – backed by private investment and corporate power purchase agreements (PPAs) to provide the required stability.

“For the renewable energy market overall, however, a future without government subsidy is one that will no longer be vulnerable to sudden shifts in policy, or to retroactive changes to promised tariffs.

“It will be one where market forces impose discipline, drive efficiencies and accelerate the cost reductions that have allowed the sector to stand on its own two feet.”

The index also highlighted growth in corporate PPAs, which it said was motivated by economic concerns – as a hedge against power prices – or for reputational reasons and to reduce carbon emissions.

Warren concluded: “The outlook for the global renewables sector remains extremely exciting.

“As renewable generation continues to become more and more affordable; increased levels of penetration are beyond doubt.

“It is perhaps the integration of renewables into the wider energy ecosystem, the sector’s contribution to the emerging low carbon e-mobility market and the integration with storage technology that will ultimately define the future for renewables.”

Attached you will find the "Renewable Energy Country Attractiveness Index"

15 May 2019

reNEWS.BIZ