Can Shell really crack the green energy market?

Shell is rebranding First Utility, the household energy supplier, under its own name - and making a commitment to renewables.

Mirror, mirror, on the wall, who's the greenest of them all?

Few would volunteer, as an answer to that question, the name of Royal Dutch Shell.

However, if the Anglo-Dutch giant achieves all it is aiming to, it just might be in a decade or so from now.

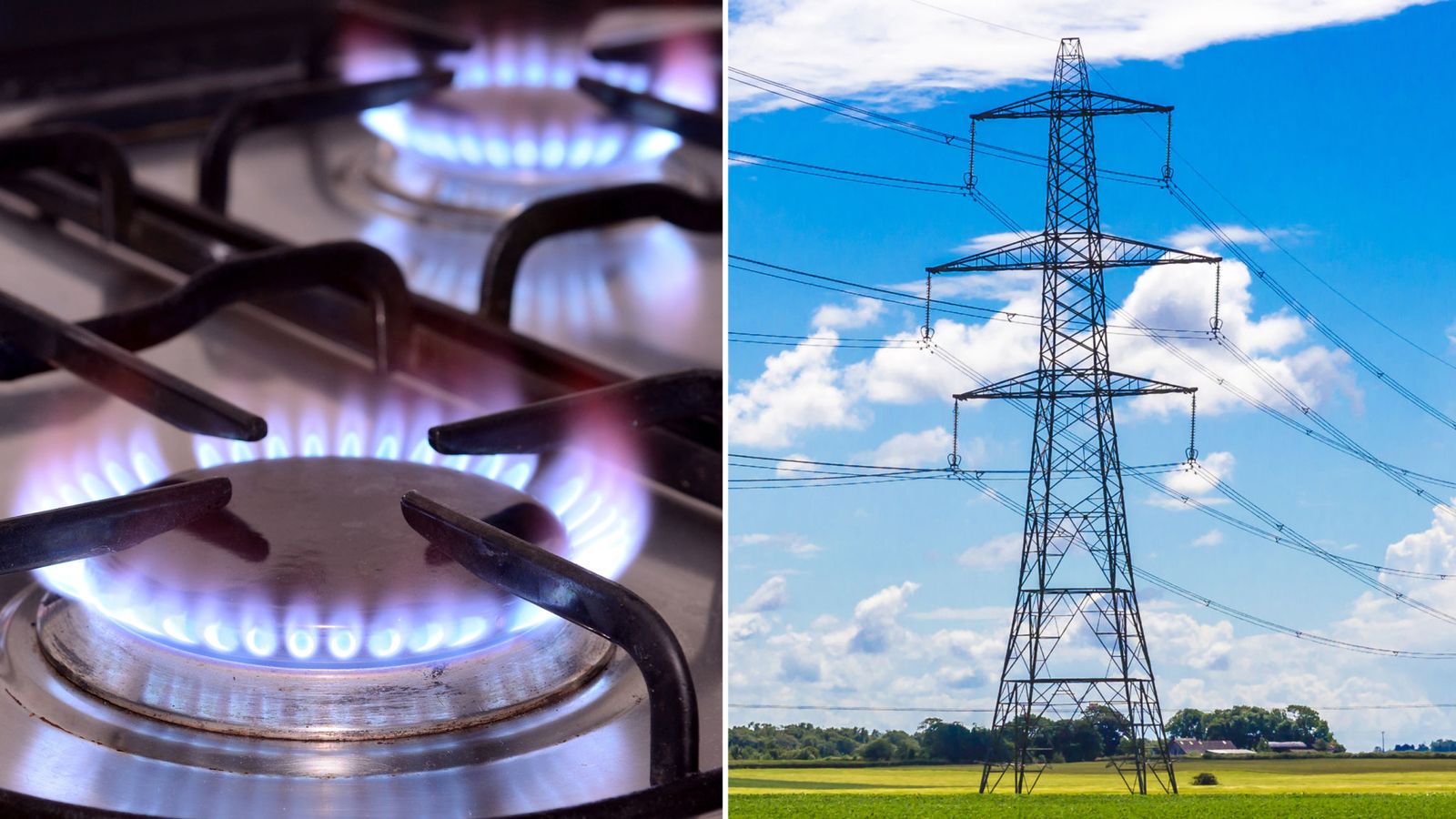

Shell announced today that it was changing the name of First Utility, the household energy supplier it bought in February last year, to Shell Energy.

The rebranding was accompanied by news that all customers will be entitled to a 3% discount at Shell service stations - and the disclosure that, from now on, all electricity supplied by the company will be from renewable sources.

Shell believes it is onto a winner with such a pledge.

According to a recent survey by pollsters Ipsos Mori, cited by Shell today, nearly 60% of all consumers want to power their homes from renewables.

The guarantee will be backed by what are known as 'Renewable Energy Guarantees of Origin' - which ensure that, for every unit of electricity Shell's customers use, a unit of electricity will be put into the grid by renewable generators.

The company is going to have to overcome a fair degree of scepticism, if not downright cynicism, from customers.

This is the same Shell, many will say, that is one of the world's biggest oil and gas companies. And indeed it is.

Yet the announcement needs to be put into the context of what Shell is doing globally.

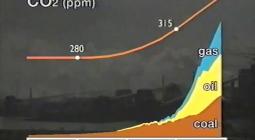

The company recently announced that, by the 2030s, it wishes to be the world's biggest electricity company and hopes to build a power business that was the same size as its oil or gas operations.

To that end, Shell has been investing heavily in putting charging points for electric vehicles into its service stations as part of a $2bn-a-year programme of investment in biofuels, wind power and battery technologies.

That still represents a comparatively small part of Shell's overall annual budget of around $25bn.

However, speaking to Sky News today, Colin Crooks, chief executive of Shell Energy, said: "You have to start somewhere.

"In 2016 we set up the new energies business, we've been spending $1bn-2bn per year, we're finding our way, we're finding where we can add value in the value chain, we want to be participating in the full value chain and globally, and let's see where we can build it."

Mr Crooks insisted that Shell had no option in making the strategic switch to power:

"Shell started out as an oil company, then we got into gas, now we're more gas than oil, we're getting into power and one day I think power has the potential to be our biggest business and we've the potential to be the biggest power business globally."

He said that, to keep global temperatures from rising by more than two degrees Celsius by the end of the century, "massive electrification" would be required.

He added: "If you want to be an important energy company in the next 120 years, like we have been in the last 120 years, you simply have to be in power.

"This is a matter of strategic imperative for us.

"Shell believes in the ambitions of the Paris agreement.

"The energy system is going to electrify over time and that electricity needs to be renewable.

"We've listened to our customers. It's taken us a year to decide exactly how to rebrand and it's not just the name and the colours, it's what are we offering.

"We talked to customers and they did tells us 'Yes, we are interested in renewable electricity, we care about that' - and we care about it too, because it's an important part of the future of energy."

Watching these developments nervously will be the traditional 'Big Six' energy suppliers - Centrica, SSE, EDF Energy, Npower, E.ON and Scottish Power.

Mr Crooks insisted today that, while Shell Energy has just 700,000 household customers today, he was "looking to go into the millions".

And that could even see Shell buying rivals.

Npower has been put up for sale by Innogy, its German parent, after its merger with the household supply arm of SSE fell apart in December last year.

Mr Crooks noted: "We've just rebranded, I think the focus is on the organic growth pathway, but I don't rule out any further routes to grow in the market."

Adding to Shell's confidence that it can build industry leadership in this area globally is its belief that traditional power companies are wedded to outdated business models.

Maarten Wetselaar, Shell's director of gas and new energies - the part of the business under which Shell Energy comes - told the Financial Times earlier this month that the established power companies were "useless".

He added: "Many of them are at a disadvantage, because they have this enormous legacy position, with coal plants and nuclear plants."

Yet some of the established energy companies are thinking along similar lines to Shell.

Iberdrola, the Spanish parent company of Scottish Power, has been vocal in its ambitions to lead the transition to renewables and, to that end, Scottish Power recently became the first of the Big Six to go 100% renewable.

At the same time, some of Shell's fellow oil majors, such as BP and Total, have also been investing heavily in electrification and the electricity supply chain.

So, too, have infrastructure operators such as National Grid.

So Shell is not going to have the field to itself.

Nor has its first year in household energy supply been an unalloyed success.

The company lost an estimated 100,000 following its takeover of First Utility but, as Mr Crooks observed, part of that was because many of the smaller energy suppliers were charging well below cost.

More than a dozen of them have since gone bust.

Some will also worry that the company has a tradition of expanding into other areas only to retreat, later, into its comfort zone of oil and gas.

For instance, in 1970, Shell diversified into mining with the acquisition of the Dutch company Billiton, seeing metals as a 'fourth leg' to the business, along with oil, gas and chemicals.

It sold the business in 1994 after suffering big losses.

But what Shell does have going for it is a colossal balance sheet giving it the freedom to take risks and to invest for the long term.

It is also being led by a chief executive, in Ben van Beurden, who passionately believes in the decarbonisation and electrification agenda.

It will ultimately be for his successors to continue driving that change over coming decades - as overcoming what is likely to be considerable scepticism among some customers.

Watch the video here

26 March 2019

![]()