Can renewables ease Africa’s energy access crisis?

Three journalists take a look at the obstacles – and benefits – to attaining universal energy access in Sub-Saharan Africa

Across Sub-Saharan Africa, countries are struggling to achieve universal energy access and clean-energy transitions. More than 600 million Africans cannot access electricity, and a lack of reliable energy continues to hurt socio-economic development in the region.

With just six years to meet the UN’s Sustainable Development Goal 7 of “access to affordable, reliable, sustainable and modern energy for all”, addressing this particular energy crisis could not be more urgent.

The energy situation across the continent is broadly characterised by weak infrastructure, underfunding, low access to reliable and clean energy, and unequal access, with supply largely focused on urban areas. In many countries, insufficient power generation is a major drag on development goals, the functioning of basic public services, and quality of life. Many sectors and daily activities are limited to daytime operating hours, including education. Healthcare services are severely impacted.

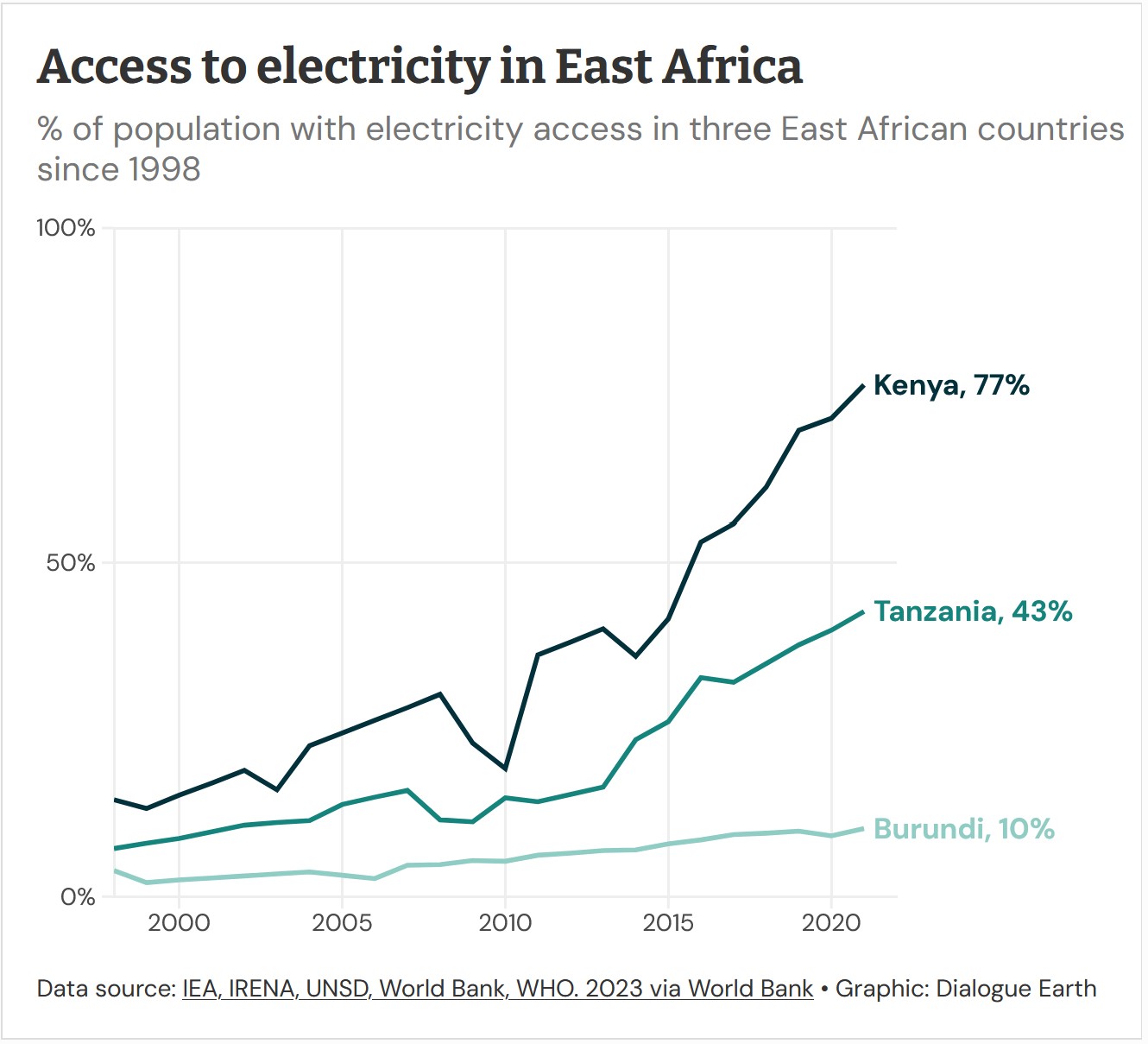

Despite progress being made in certain countries, the situation is worsening at the continental level. Between 2019 and 2021, the number of people in Africa living with no access to electricity increased by 4%. Meanwhile, better-off nations such as Kenya, Rwanda and Ghana are on course to reach universal coverage by 2030, according to the IEA (International Energy Agency).

Renewable energy is a potential equaliser. With several large projects on the horizon, how are African countries trying to close their energy-access gaps? And what stands in the way?

East Africa

No East African country has achieved full electricity access, and levels of access differ vastly in the region. Kenya enjoys the greatest access by far – 75% in 2018 – followed by Tanzania – thought to be approaching 38% in 2020. Meanwhile, neighbouring Burundi had just 10% access as of 2021. (Burundi, Ethiopia, Kenya, Rwanda and Sudan primarily obtain their electricity through renewables.)

Though there have been big differences in strategies for expanding electricity production in the region, countries have been coordinating efforts to improve energy access. Most notably, the Eastern Africa Power Pool (EAPP), established in 2005, aims to contribute to universal energy access by facilitating interconnection of electricity grids.

Larger economies in the region have also been developing their own clean-energy strategies. Kenya has forged ahead with its plans for renewable-power generation via geothermal, solar and wind energy – after scrapping a proposed coal power plant in the port city of Lamu. As a result, by 2021, roughly 81% of Kenya’s electricity generation came from renewables. The government has also been exploring the possibility of building facilities to produce green hydrogen, and released a plan in 2023 to promote the industry.

Hydropower has been touted as an answer to energy-access issues in recent years. It accounted for an average of 17% of African electricity generation as of 2019. However, erratic rain patterns exacerbated by climate change has made it unreliable, contributing to electricity supply gaps amid increasing regional demand.

Despite this, a number of East African countries have been betting on hydropower. Ethiopia has pushed forward its low-carbon energy agenda with its Grand Ethiopian Renaissance Dam. Once completed, the dam will have a capacity approaching 6.5 gigawatts (GW), making it Africa’s largest such facility. Meanwhile, in Tanzania, the Rufiji hydropower project is expected to be operational this year.

Solar is also proving popular. A total of 27 utility-scale solar photovoltaic (PV) plants, representing nearly 2.6 GW of capacity, have currently either been announced or are in construction in East Africa, according to Global Energy Monitor.

However, many of these projects come with the caveat of being owned or financed by foreign entities. Governments in the region generally lack the required upfront capital to invest in megaprojects, says Richard Kimbowa, who chairs the East African Civil Society for Sustainable Energy and Climate Action. Kenya is relying on European Union financing to realise its green-hydrogen ambitions. Ethiopia is using a mixture of bond sales, domestic investment and equipment financing from Chinese banks to complete its Renaissance Dam. The Nkonge Solar Farm in Uganda is owned by a European energy investment company.

East Africa has otherwise been increasingly dependent on public-private partnerships (PPPs), Kimbowa notes. PPPs are long-term agreements between governments and private entities, in which public funding de-risks projects to attract private investors. Such arrangements have been used for Kenyan geothermal projects and the Bujagali hydropower plant in Uganda.

Despite enabling projects to be greenlit and financed, PPPs for renewable energy on the continent face several challenges. For example, in 2016 the Zimbabwe Economic Policy Analysis and Research Unit said an overreliance on external experts and consultancies was increasing the total cost of such projects, and hindering the growth of local expertise. In Uganda, a national study of the key risks linked to PPPs identified over 30 for the energy sector, including ballooning project costs and government interference.

West Africa

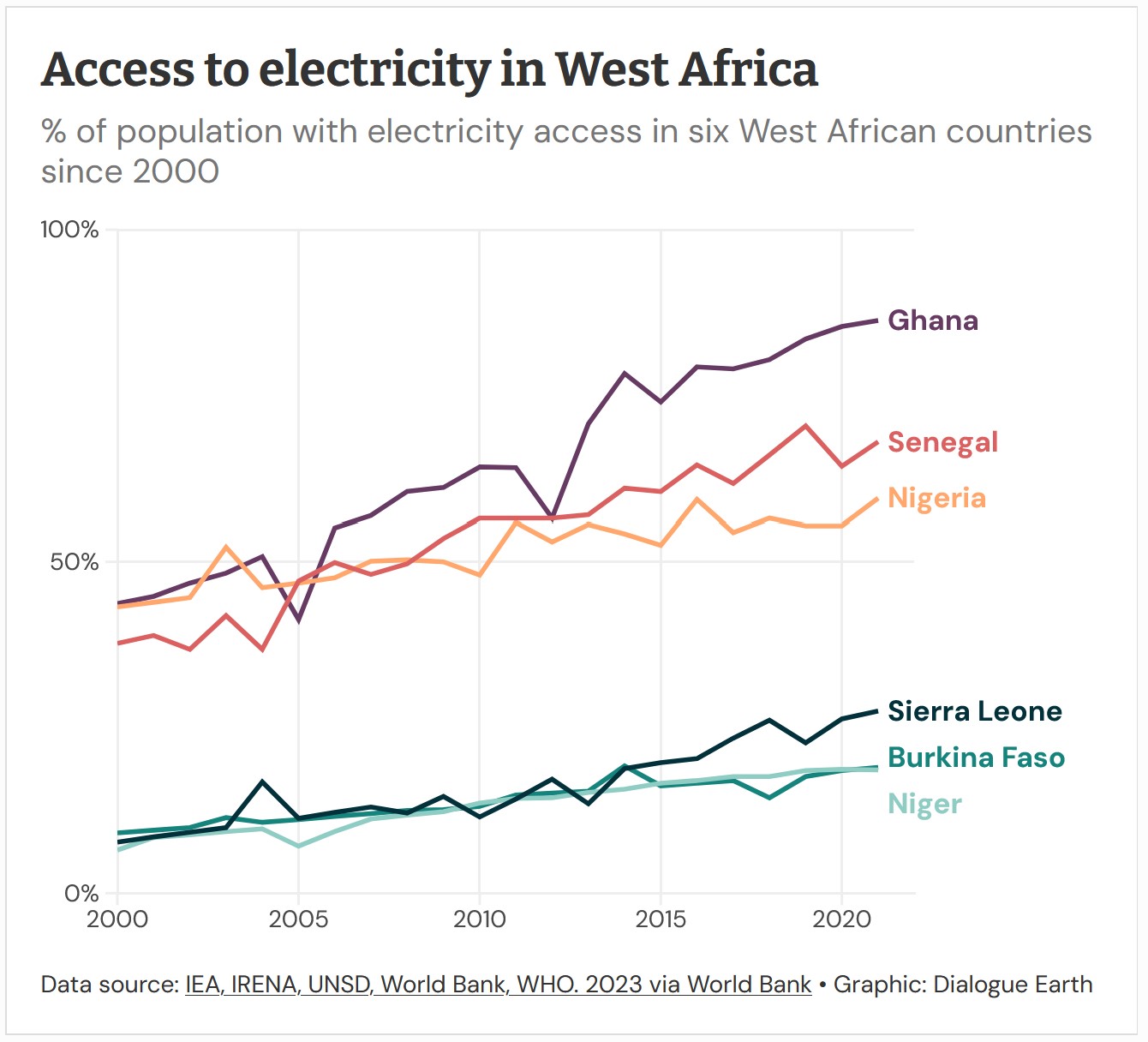

Access to electricity in West Africa varies significantly. Some of the region’s larger economies, such as Ghana, Nigeria and Senegal, have urban electricity access rates beyond 80% – representing steady growth since the 1990s. Meanwhile, countries such as Burkina Faso, Niger and Sierra Leone are lagging behind at around 55-65%.

Many in the region still rely on burning wood and charcoal for cooking and heating. As for electricity, fossil fuels remain the go-to option for most: in 2021, 42% of West African electricity came from gas and 37% from petroleum products, according to a report by the Economic Community of West African States (ECOWAS).

The report says solar power has emerged as a significant opportunity and the fastest growing source of electricity generation in West Africa, with a 48% increase in 2021 alone. This growth has been aided in part by the establishment of a number of energy start-ups in the region. In 2020, the IEA stated that solar PV was already the cheapest source of energy in many parts of Africa and would be the cheapest continent-wide by 2030.

West Africa requires more financing to meet its energy needs, however. As is true across the continent, many state-owned utility companies are in poor financial health. This makes it difficult to fund the grid modernisation necessary for a renewable energy influx, according to a 2023 IEA report.

A number of initiatives have been attempting to solve this issue. In 2021, the World Bank Group funded the Regional Electricity Access and Battery-Energy Storage Technologies Project to increase grid connections in vulnerable areas of the Sahel (a semi-arid region bordering the Sahara Desert.) The USD 465 million project aims to build the capacity of the ECOWAS Regional Electricity Regulatory Authority, and accelerate energy access in Mauritania, Senegal and Niger.

In December 2022, the World Bank also approved the USD 311 million Regional Emergency Solar Power Intervention Project. This is designed to assist Chad, Liberia, Sierra Leone and Togo in increasing their grid-connected renewable-energy capacity, while also increasing regional integration. The project aims to reduce greenhouse gas emissions by installing 106 megawatts (MW) of solar PV.

A 2020 report by the International Renewable Energy Agency (IRENA) summarised a broadly positive outlook for West Africa’s renewables development, citing plentiful resources to be harnessed for economic development. It added that cross-border energy-trade improvements would increase access to reliable and affordable power for citizens and businesses.

Southern Africa

Energy shortages have affected the region since 2007. A 2019 report by the Southern Africa Development Community economic bloc blamed ageing infrastructure, weak energy policy and regulatory instruments, and unaffordable renewable energy. That year the bloc also noted that about half of the region’s population has access to electricity, dropping to 32% in rural or remote areas.

Southern Africa has an abundance of renewable resources – particularly solar – but renewables currently account for a fraction of total power capacity. However, this share is rapidly growing within the Southern African Development Community, from 23% in 2015 to almost 39% in 2018, according to IRENA.

This renewable-energy potential is being overshadowed by the availability of coal in most countries in the region, as well as oil in Angola and gas in Mozambique. Patrick Bond, a sociology professor at the University of Johannesburg, tells Dialogue Earth that these factors are slowing down the expansion of renewables. In South Africa, vested coal, oil and gas interests have won massive subsidies from successive governments, which pose a major obstacle for the energy transition, he adds. In Mozambique, the Italian oil and gas conglomerate Eni started commercial gas production in 2022; Shell and TotalEnergies announced significant offshore discoveries of oil and gas in Namibia that same year. Much of this product is ultimately destined for export.

Nonetheless, renewable energy is fast becoming a useful resource for the region’s industrial needs. In Zambia, First Quantum Minerals is building a 430 MW renewable-energy project to power two of its mines, comprising 230 MW of solar PV and 200 MW of wind. In Zimbabwe, the Chipangayi Renewable Energy Technology Park will include solar PV, green-hydrogen production and storage, fuel cells and lithium-ion batteries.

Despite these national pushes for renewable energy, it remains inaccessible for many. In South Africa, for example, Bond says solar PV installations are mostly found atop middle-class homes. He worries this could prevent cross-subsidisation of electricity in the future, ultimately impacting poorer families.

The region is also eyeing hydropower megaprojects, as seen in the revival of Mozambique’s proposed Mpande Nkua and Inga dams on the Congo River. But droughts – worsened by El Niño – have already caused a number of Southern African countries to declare a national disaster. This has undermined the reliability of the Zambezi River’s Kariba dam as a source of electricity for Zimbabwe and Zambia.

Conclusion

It will be challenging – but not impossible – for Sub-Saharan Africa to ensure access to affordable, reliable, sustainable and modern energy for all of its people by 2030. As climate change continues to push up temperatures and provoke extreme weather, the impacts will be particularly stark among African countries with vastly differing energy-access levels. Regional cooperation and an equitable, widespread rollout of renewable energy are perhaps the most crucial ingredients for success.