GWEC-Global Wind Report 2018.

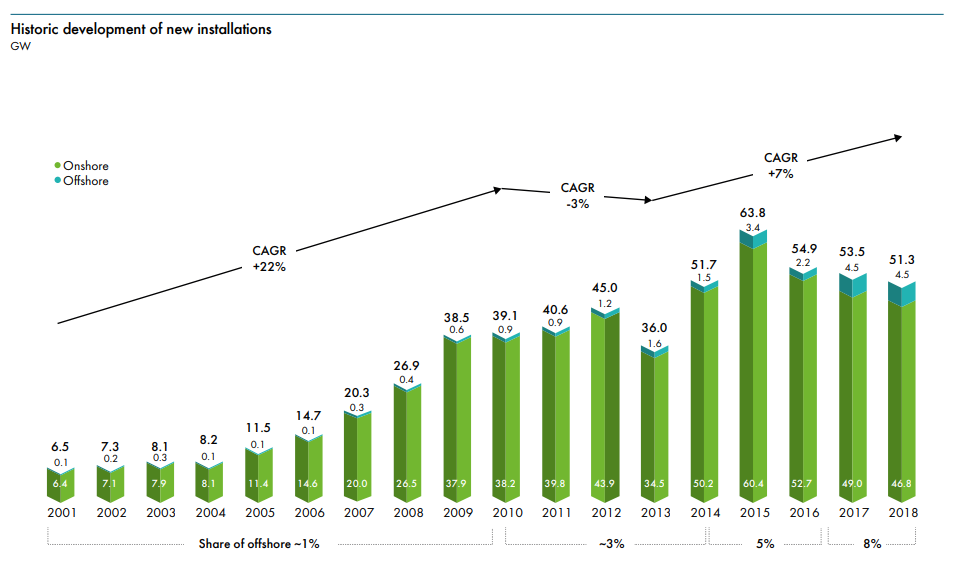

Good year for wind energy with 51.3 GW new installations.

According to the 14th 'Global Wind Report' from the Global Wind Energy Council and as GWEC director of market intelligence Karin Ohlenforst said: “2018 was a good year for the global wind industry, with installations remaining above 50GW".

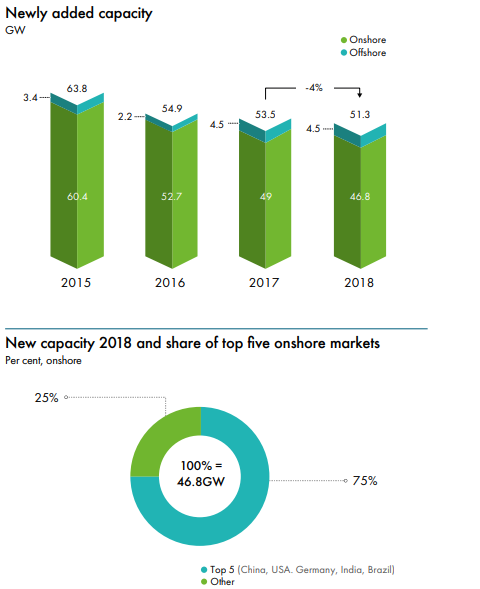

With 51.3 GW of new wind energy installed, a slight decrease of 4.0 per cent compared to 2017, but a strong year, nonetheless. Since 2014, annual installations have topped 50 GW each year, despite ups and downs in some markets.

Market status and outlook

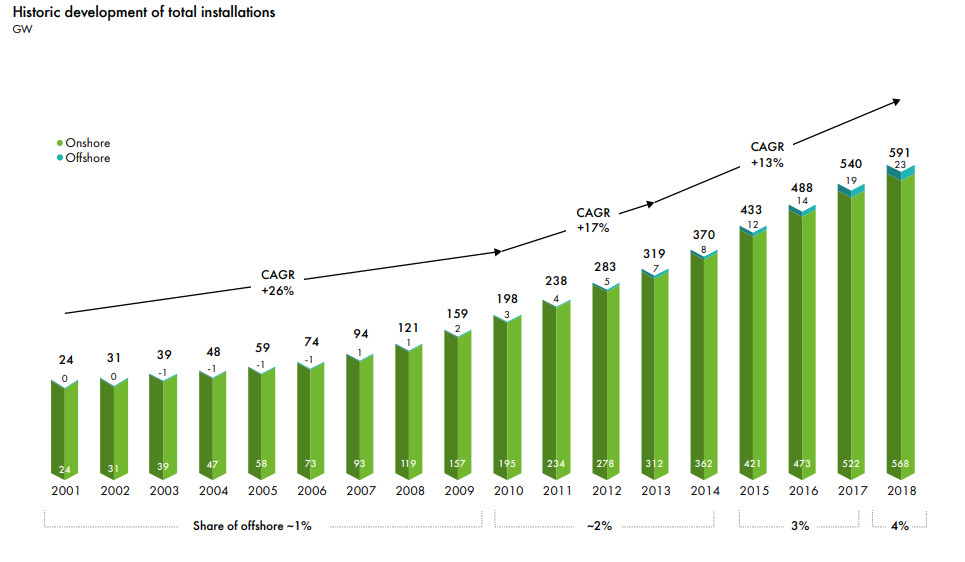

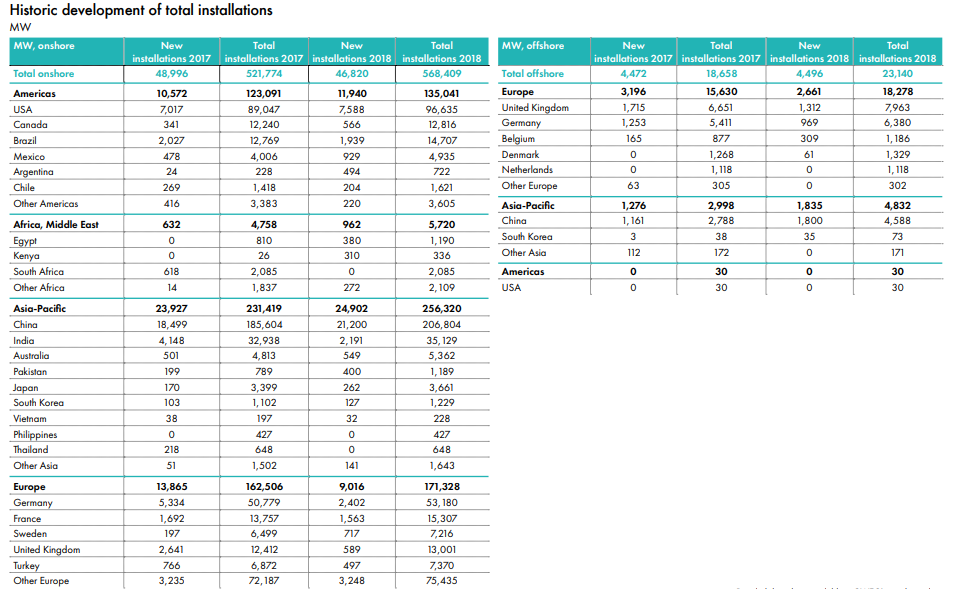

The 51.3 GW of new installations brings total cumulative installations up to 591 GW. In the onshore market, 46.8 GW was installed, a decrease of 4.3 per cent compared to 2017. China and USA remained the largest onshore markets with 21.2 GW and 7.6 GW new capacity respectively. The European onshore market installed 9 GW, a 32 per cent decrease compared to 2017. Growing developing markets in Africa, the Middle East, Latin America and South-East Asia installed a combined 4.8 GW during 2018 (nearly 10 per cent of all new installations), up from eight per cent in 2017 when these markets installed 3.8 GW.

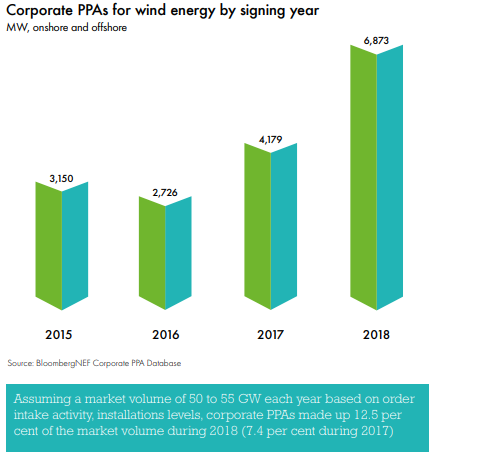

GWEC expects the onshore market to install upwards of 50 GW per year until 2023. Mature markets in Asia, Europe and North America will continue with stable volumes. Growth will come from developing wind energy markets in Africa/ Middle East, Latin America and South-East Asia. The global offshore market remained stable in 2018 with 4.5 GW of new additions, the same market size as in 2017. The total cumulative installations has now reached 23 GW, representing four per cent of total cumulative installations. GWEC expects increasing offshore installations first in Asia and then in North America, and annual offshore installations reaching 6 GW or more in the near future. Market dynamics continued to change in 2018. Many industry players revised their business models and strategies by acquiring new subsidiaries in related fields and/or expanding services offered. The volume of corporate sourcing or corporate PPAs has reached 6.4 GW for wind energy (BloombergNEF), and new solutions such as hybrids and co-located projects are under development, increasing the focus on cost efficiency, ease of integration and supply security. GWEC expects both the shortterm and long-term growth of wind energy to be impacted by these three areas – revised business models, corporate sourcing and new solutions.

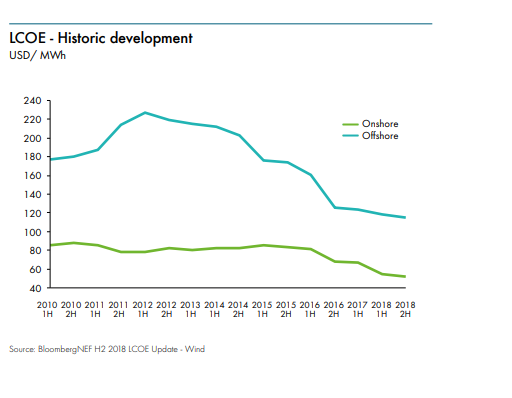

The wind industry has been able to prove its increasing maturity, cost competitiveness and efficiency by relying on one of the most important measures in the energy industry – Levelised Cost of Electricity (LCOE).

New installations in the onshore wind market reached 46.8 GW, and the global offshore market installed 4.5 GW, bringing the share in the global market to now eight per cent. The Chinese onshore market installed 21.2 GW in 2018 and has been the leading market since 2008.The second largest market in 2018 was the US with 7.6 GW of new onshore installations and total onshore installations of 96 GW.In addition to China and USA, the top five wind markets in 2018 are completed by Germany (2.4 GW), India (2.2 GW) and Brazil (1.9 GW).

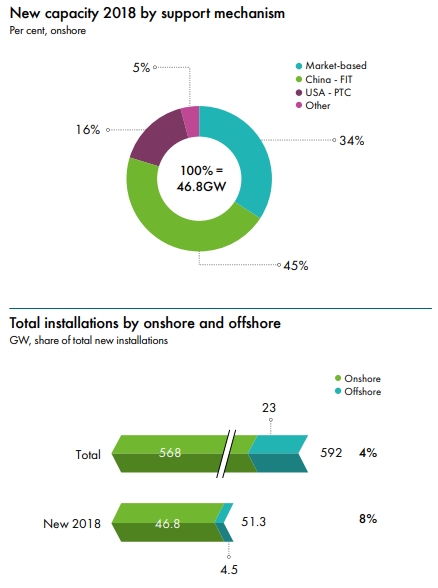

Excluding the two largest markets, China and USA, market-based mechanisms, such as auctions, tenders, and Green Certificates, were the main drivers behind new installations in 2018: For the onshore market, 16 GW of new installations or 35 per cent of new installations originate from marketbased mechanisms. This level can be expected in the future, as 15 GW of onshore wind capacity was auctioned during 2018. The dramatic decreases of bid levels and equipment prices, as seen in 2016 and 2017, have slowed down in 2018, and bid levels will continue to stabilise in 2019. Continuing efforts to increase efficiency and lower cost means that the wind industry will be able to respond to changing market conditions in the future.

Over 300GW of new wind capacity will be added in the next five years, according to the report and offshore wind development will continue to accelerate with 40GW installed over the period, accounting for 15% of new projects each year.

Emerging markets for wind power will include Indonesia, Philippines, Thailand, Vietnam, Argentina, Colombia and Peru.

Governmental support, in the form of auction and tender programmes and renewable targets, will continue to be a significant driver for new installations, it added.

Opportunities for wind energy to operate on a commercial basis are increasing as the industry continues to prove its cost-competitiveness and bilateral agreements, such as corporate power purchase agreements, grow, GWEC said.

The report said the main drivers of future market growth, aside from regulation and government targets, are changing business models of industry participants, corporate procurement outside of mature markets, and value-focused solutions, such as hybrid generation plants.

“The dominance of onshore wind power is not surprising given continued and growing investment, with market-based mechanisms like auctions, tenders and Green Certificates being the main drivers of new onshore installations, accounting for 35% of total installations.

“2018 was also a pivotal year for the offshore industry, particularly in Asia. If governments remain committed, offshore wind will become a truly global market in the next five years.”

GWEC chief executive Ben Backwell said: “We have changed the way we gather, analyse and share data. This year’s Global Wind Report is built on our new and improved market intelligence function that offers unmatched exclusive data and insights.

“We are growing our team and are more dedicated than ever to steering the industry and supporting our members into new and exciting opportunities for wind energy.”

Read the full GWEC-Global Wind Report 2018 here

2 May 2019