Green energy firms on track to deliver multibillion-pound windfarms.

Companies want to power greener economic recovery following Covid-19 pandemic.

Britain’s biggest green energy companies are on track to deliver multibillion-pound windfarm investments across the north-east of England and Scotland to help power a cleaner economic recovery.

Scottish Power plans to “repower” Scotland’s oldest commercial windfarm as part of a £150m scheme to develop a clean energy cluster in central Scotland capable of supplying 100,000 homes with green electricity.

The windfarm cluster is expected to create 600 jobs at its peak, and 280 long-term jobs, to help the UK emerge from the worst economic downturn in 300 years while taking steps to meet its climate goals.

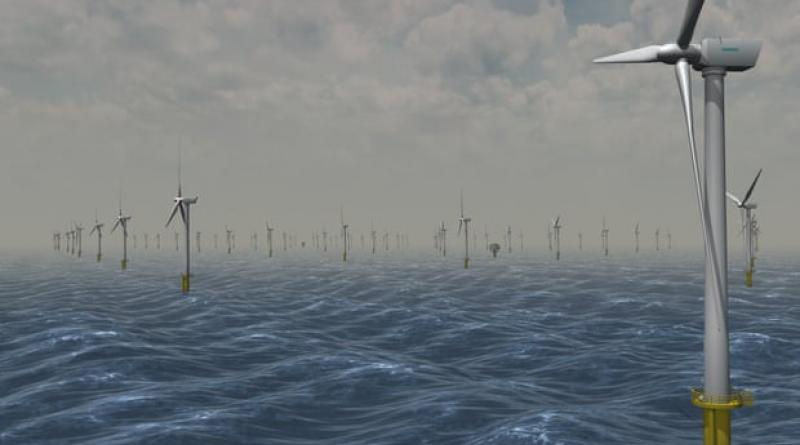

Separately SSE and Equinor have revealed plans to use the Port of Tyne to host the operations base for the world’s largest offshore wind development, which will create 200 permanent jobs and support a local supply chain industry based on clean energy.

Alok Sharma, the secretary of state for business, said projects like the Dogger Bank offshore windfarm will be “a key part of ensuring a green and resilient economic recovery as well as reaching our target of net-zero emissions by 2050”.

“Renewable energy is one of the UK’s great success stories, providing over a third of our electricity and thousands of jobs,” he said.

Keith Anderson, the boss of Scottish Power, told the Guardian that work to upgrade Scotland’s first commercial windfarm, Hagshaw Hill, will come alongside two separate agreements to buy two nearby development projects to create a clean energy cluster in South Lanarkshire totalling 220MW.

The project is part of the company’s plan to develop 1,000MW of onshore wind power and battery storage after the government’s u-turn on support for onshore wind, but could also play a role in resuscitating the UK economy following the coronavirus pandemic, he said.

“We’re kickstarting as many of our projects as we can so they are ready to help boost the economy when the pandemic ends. Not only do these projects help funnel money back through the supply chain and into jobs but they also make sure that the economic recovery is based on sustainable investments,” he said.

Ignacio Galán, the chairman and chief executive of Iberdrola, which owns Scottish Power, said it is essential the financial recovery is aligned with climate goals. “As we begin to emerge from the coronavirus crisis, investment in green infrastructure can quickly be delivered, creating jobs and offering immediate economic and environmental benefits. This will help to support the UK’s overall recovery at this critical time,” he said.

In the north-east, the £9bn Dogger Bank offshore wind development is on track to bring investment to the UK “at a challenging time for us all”, according to Stephen Bull, the head of Equinor’s UK business, which runs the site. Equinor and SSE Renewables picked the Port of Tyne to host the operations hub through a competitive tendering process, following its £10m overhaul to prepare for a surge in demand from windfarm developers.

“The north-east has a strong industrial heritage and a supply area that stretches north and south of the River Tyne,” said Bull. “The Port of Tyne is clearly well set up to attract other clean energy investment which we hope will complement our activities.”

Matt Beeton, the Port of Tyne’s chief executive, said the project is “extremely important for the wider region” in terms of spurring economic benefits for the local supply chain and creating employment opportunities. “This announcement is a huge step towards developing a cleaner future for the Port, the region and for industry in the north-east,” he said.

13 May 2020

The Guardian