The Other Fossils in the Boardroom.

The sustainable revolution hasn’t reached the top levels of the biggest U.S. and European banks.

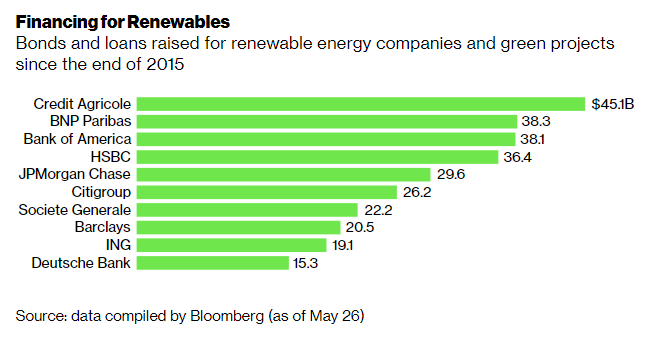

The world’s largest banks have issued billions in loans to sustainable businesses and taken some steps to restrict funding for some of world’s worst polluters. But the greening of global finance hasn’t reached the boardroom yet.

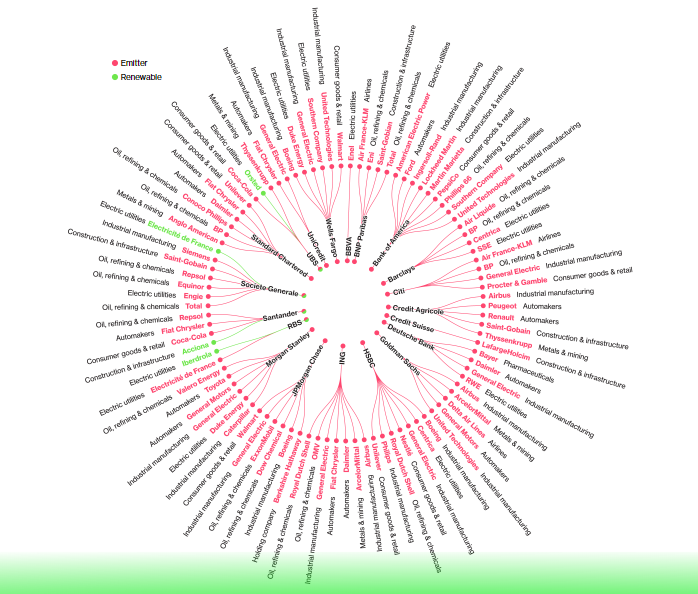

Executives with direct links to the clean-energy future rarely hold senior leadership positions or sit on the boards at 20 leading U.S. and European banks. Bloomberg Green analyzed the past and present professional affiliations of more than 600 directors and executives and found only a few with experience in renewable or sustainable industries.

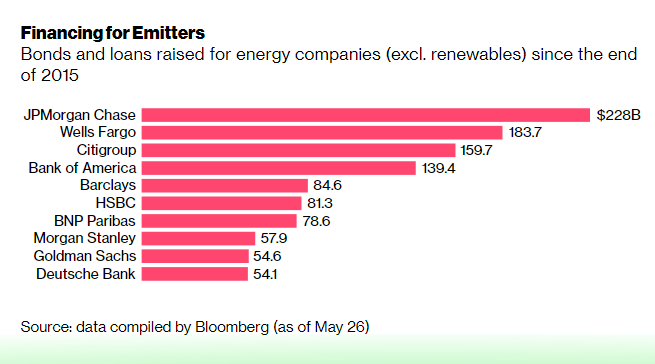

Far more had ties to polluting industries: At least 73 have at one time or another held a position with one or more of the biggest corporate emitters of greenhouse gases, including 16 connected to oil or refining companies. The same 20 banks have helped arrange almost $1.4 trillion of debt financing for fossil fuel producers since the signing of the Paris climate agreement in 2015.

One of the clearest successes of the movement to emphasize environmental, social and governance criteria has been to make it uncomfortable for banks to ignore diversity in the top levels of management. That push for inclusion is based on the principle that having varied viewpoints in corporate decision-making, including women and people of color, is both important and worthwhile. Yet even though environment is a stated goal of the ESG movement, representation has barely budged for executives with a background in climate-friendly industries.

“Boards needn’t have a technical climate expert, but they do need to have a greater grasp of how climate impacts their businesses,” says Mark McKenzie, who heads accounting firm KPMG International Group’s global center on climate and sustainability. “Having someone with green experience at that top level—that buy-in—makes an enormous difference.”

Here are some of the bank boards from our analysis with the deepest ties to emitters—plus one company that’s produced more directors than anywhere else. The review focused on U.S. and European banks because they are the most active financiers of fossil-fuel companies and renewable energy producers.

JPMorgan

A legendary oilman and climate skeptic has been a presence on the board of the biggest Wall Street bank for more than three decades—and soon his tenure at the helm will be up.

Few people have had more power inside JPMorgan Chase & Co. than Lee Raymond, the former chief executive officer and chairman of Exxon Mobil Corp. He’s been the lead independent director at the bank since 2013, an adviser on long-term strategy, and a sounding board for JPMorgan CEO Jamie Dimon.

But now, after coming under scrutiny from climate critics and shareholders, Raymond is stepping aside. Among those seeking to oust him from the board’s leadership are New York’s city and state pension funds, which argued that the former Exxon boss doesn’t have the impartiality or understanding of global warming to fulfill his duties. Raymond was reelected to the JPMorgan board at its annual shareholder meeting in May, but the bank is planning to name a new lead director by the end of summer.

JPMorgan has said it supports the 2015 Paris Agreement, recognizes the challenges posed by climate change, and is more than halfway to a goal of facilitating $200 billion of clean-energy financing through 2025. It also had about $42.8 billion of loans out to the oil and gas industry at the end of March, the second most among the biggest U.S. banks after Citigroup Inc., according to company filings.

ING

No bank has a greater share of its board with ties to the planet’s biggest polluters than ING Groep NV. As of early May, six members of the Dutch lender’s 15-person management and advisory board have worked at or served on the boards of Royal Dutch Shell, Daimler and other polluters. None of its members have links to renewable energy, although Chairman Hans Wijers served as chair of an environmental association, Natuurmonumenten, until May 2019.

The lack of renewable energy experience at the top hasn’t stopped ING from addressing climate risks ahead of many of its rivals. The bank first took steps in 2005 when it disclosed its carbon footprint. And ING is steering its more than 600 billion-euro ($659 billion) book of loans to companies working toward meeting goals outlined in the Paris Agreement. ING says every member of its supervisory board is expected to contribute to discussions “about delivering on our ambitions,” including issues related to sustainability.

Credit Agricole

Christian Streiff was among those with the greatest number of ties to the world’s top emitters, having at various points in his career served as CEO of Airbus SE and Peugeot, and as a senior executive at Europe’s biggest building-materials supplier, Cie. de Saint Gobain. He also was previously a director at Thyssenkrupp, Germany’s largest steelmaker.

But change has come: Streiff stepped down from the bank’s board in May, and his replacement has far more green experience: Marie-Claire Daveu, chief sustainability officer at French fashion company Kering. Daveu was previously a director of sustainable development at Sanofi-Aventis Group and also worked at France’s Ministry of Ecology and Sustainable Development.

General Electric

General Electric Co.—which made the Climate Action 100+ list of the world’s most significant emitters—has a long track record of training executives who then move on to lead other companies, including 11 board members or leaders at eight of the largest U.S. and European banks. That’s more than double the number of links of any other corporate emitter included in Bloomberg’s analysis.

Several of these left GE before the company started its decades-long pivot to greener technologies, most notably Ranieri de Marchis, the current UniCredit SpA co-chief operating officer, who once served as chief financial officer of GE’s oil and gas division. GE’s once-sprawling financial arm has several alumni who are now executives at big banks.

UBS

One of the few bank board members with renewable-energy experience is Dieter Wemmer, who’s on the board of UBS Group AG. He also serves as a board member of Orsted AS, the world’s biggest developer of offshore wind farms, where he is chair of its audit and risk committee.

Wemmer says having people with green experience, and more importantly a green “mindset,” on boards is becoming more relevant at banks. UBS recently concluded interviews with incoming CEO Ralph Hamers, in which sustainability and discussions about ESG principles were a key part of the recruitment process, he says.

“It is the right time to focus on a green future,” Wemmer says. “For me, it is more relevant now than it was before the Covid-19 pandemic.”

Green Bona Fides

Here are other banking executives and board members with sustainable connections, mostly at organizations that aren’t among the world’s biggest renewable energy producers as ranked by BloombergNEF:

Sharon Allen, a board member at Bank of America Corp., also is on the board of First Solar Inc., the largest U.S. panel maker.

Lena Wilson, a Royal Bank of Scotland Group Plc board member, also is on the board of Iberdrola SA’s ScottishPower Renewables unit. Iberdrola was the world’s first major utility to embrace renewable energy more than a decade ago.

HSBC Holdings Plc Chairman Mark Tucker co-founded Chapter Zero, a forum for business executives to learn how climate change is impacting their companies and industries. Jose Antonio Meade Kuribrena, an HSBC board member, is a commissioner for the Global Commission on Adaptation, a group co-led by former United Nations head Ban Ki-moon that seeks to prepare cities and countries for disruptions caused by climate change. Kuribrena also is on the board of Mexican holding company Alfa SAB de CV, which has a petrochemicals business.

Michael Klein, a board member at Credit Suisse Group AG, also is on the board of Conservation International. Fellow Credit Suisse director Ana Paula Pessoa has been on the board of the Nature Conservancy Brazil since 2014.

Fred Hu, who’s on UBS’s board, is co-chairman of the Nature Conservancy Asia Pacific Council.

Rob Herz, who’s on Morgan Stanley’s board, is a director of the Sustainability Accounting Standards Board Foundation, which oversees the SASB Standards Board. Mary Schapiro, also a Morgan Stanley board member, is vice chair of SASB’s board. (Note: Schapiro is also vice chair for global public policy at Bloomberg LP).

—With reporting by Michelle Davis, Marion Halftermeyer, Sonia Sirletti, Charlie Devereux, Emily Chasan, Max Reyes, Olivia Raimonde, Natalia Kniazhevich, and Marcus Lefkandinos (Global Data)

3 June 2020

Bloomberg Green