Investors: Sustainable Finance Demands More than Just Cutting Carbon

Sustainable investing is a key part of curbing climate change, and the sector is showing some signs of progress.

As in the rest of the private sector, where at least 20% of the world’s 2,000 largest public companies have committed to achieve net-zero emissions by 2050, many leading investors are also focused on reducing carbon emissions. For example, more than 450 firms representing $130 trillion in assets under management have joined the Glasgow Financial Alliance for Net Zero, a coalition of sector-specific initiatives from banks, asset managers, asset owners, insurers and other financial service providers.

But reducing emissions, also known as mitigation, isn’t the only thing investors need to do to avoid the worst impacts of climate change.

As laid out by the international Paris Agreement on climate change, we also need to build resilience to climate impacts and ensure a just transition for workers and communities affected by climate action. Achieving these goals will require a more holistic, comprehensive concept of sustainability in finance. Without it, investors will miss an opportunity for impact and a competitive edge.

The Real Definition of Paris Agreement-aligned Finance

Sustainable finance is one of the Paris Agreement’s three main goals, which calls for “making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development.” Achieving the financial component is essential to achieving the Agreement’s other two goals: limiting temperature rise to 1.5 degrees C (2.7 degrees F) and adapting to a changing climate, both achieved in a way that fairly shares the costs and benefits of the transition to a low-carbon economy, known as a just transition.

While investors primarily prioritize the temperature goal and its requisite emissions reductions, they should be just as focused on adaptation and a just transition. Without a just transition that does right by workers, Indigenous and frontline communities, and others whose lives and livelihoods may be threatened by actions taken to achieve a low-carbon, climate-resilient economy, the Paris Agreement goals will not be met.

In the most basic terms, climate transitions won’t happen without social justice. And without climate transitions, the impacts of climate change will continue to become more severe — not just on humanity, but on market returns.

Why Investors Should Prioritize Resilience to Climate Change

Climate adaptation should matter as much to investors as climate mitigation. Companies they invest in need to be prepared for the impacts of a warming world — from the acute effects such as crop-killing heatwaves to chronic ones including climate-induced migration. Conversely, some firms may benefit from offering products essential to a more climate-resilient future, such as hardier crops or building retrofits.

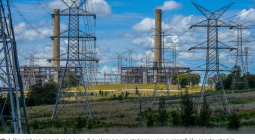

Investors should understand this useful market intelligence. The International Monetary Fund found that direct damage from climate impacts cost $1.3 trillion from 2010-2019. Every hurricane, drought, fire and flood brought on or exacerbated by climate change can close businesses, destroy stock and require workers to miss time. These physical impacts translate into lost returns. WRI’s study of Indian thermal power plants described the ways that drought could shut down power generation and hurt profits.

Smart businesses and institutional investors are already acting on these risks. But the concern is not systematically integrated into investment products, particularly passively managed funds such as mutual funds and ETFs. Those funds rarely consider resilience or physical risk.

This is partly because of how difficult it is to measure, categorize and analyze physical risk. Frameworks for disclosing physical risks are patchy, leaving even investors trying to put together a sustainable fund or product using potentially shoddy, immaterial or incomplete information.

Still, no fund can ignore climate impacts. Companies, as constituents of those funds, should proactively incorporate physical climate risks into their overall risk management and make business decisions to increase their resilience to physical climate impacts.

Investors can directly invest in adaptation projects to support companies’ efforts of improving their resilience, but also to improve the resilience of communities where companies operate and their employees live. After all, even if the lights are on at the factory following a storm, productivity is going down if workers find roads, bridges or trains offline. Companies with better adaptation and resilience practices will be rewarded by investors with stock purchases and lower costs of capital.

Why Investors Should Prioritize a Just Transition

For some investors focused primarily on impact, or doing good, a just transition is an easy sell. But investors focused principally on returns should also recognize the materiality of the just transition — and that it’s a great, long-term play. The financial performance of a company increasingly relies on its practices in the workplace, the community in which it operates, and how it improves society as a whole.

The Paris Agreement is clear in its endorsement of a just transition because climate action moves faster and more effectively when it energizes masses of people and avoids harming those it seeks to protect. For example, according to Climate Focus, reaching the Paris Agreement without protecting Indigenous lands is “impossible” since Indigenous and local communities occupy and protect a large amount of the world’s carbon-storing forests.

Firms that do not buy into the need for a just transition may suffer from reputational risks. The balancing act can be complex, as seen in case studies from Morocco to Alberta. For example, a cadmium mining company whose metal might be used in solar photovoltaic cells may nevertheless pollute the water for nearby communities, endangering its corporate reputation even though its product is helping reduce carbon emissions.

Investors will need to proactively identify material just transition issues and perform rigorous due diligence in selecting investments. They should also integrate just transition issues in their stewardship processes, such as engagement and proxy voting, to drive investees towards a just transition.

Going Beyond Net-zero Emissions in the Finance Sector

Paris Agreement alignment is a holistic process. Other elements sustainable investors should consider include, for example, whether the companies they’re backing have aligned their lobbying efforts with climate action. And do-no-harm policies that exclude fields like tobacco and weapons can ensure Paris Agreement-aligned investments meet a minimum baseline standard across other issues.

While many investors have made net-zero commitments to reduce carbon emissions, the Paris Agreement — whose goals almost every government on Earth is committed to realizing — goes far beyond emissions reductions. It establishes goals and a vision of building a decarbonized, climate-resilient, inclusive and equitable global economy.

In the rush for sustainable investing, standards and marketing copy have sometimes been out of sync. A Paris Agreement-aligned investment only exists where all three factors — mitigation, adaptation and just transition — are incorporated.