Nuclear more costly and could ‘sound the death knell’ for Australia’s decarbonisation efforts, report says

A nuclear-powered Australian economy would result in higher-cost electricity and would “sound the death knell” for decarbonisation efforts if it distracts from renewables investment, a report by Bloomberg New Energy Finance (BNEF) argues.

The report comes as ANZ forecast September quarter power prices will dive as much as 30% once government rebates kick in. A separate review by the market watchdog has found household energy bills were 14% lower because of last year’s rebates.

BNEF said the federal opposition’s plan to build nuclear power stations on seven sites required “a slow and challenging” effort to overturn existing bans in at least three states, for starters.

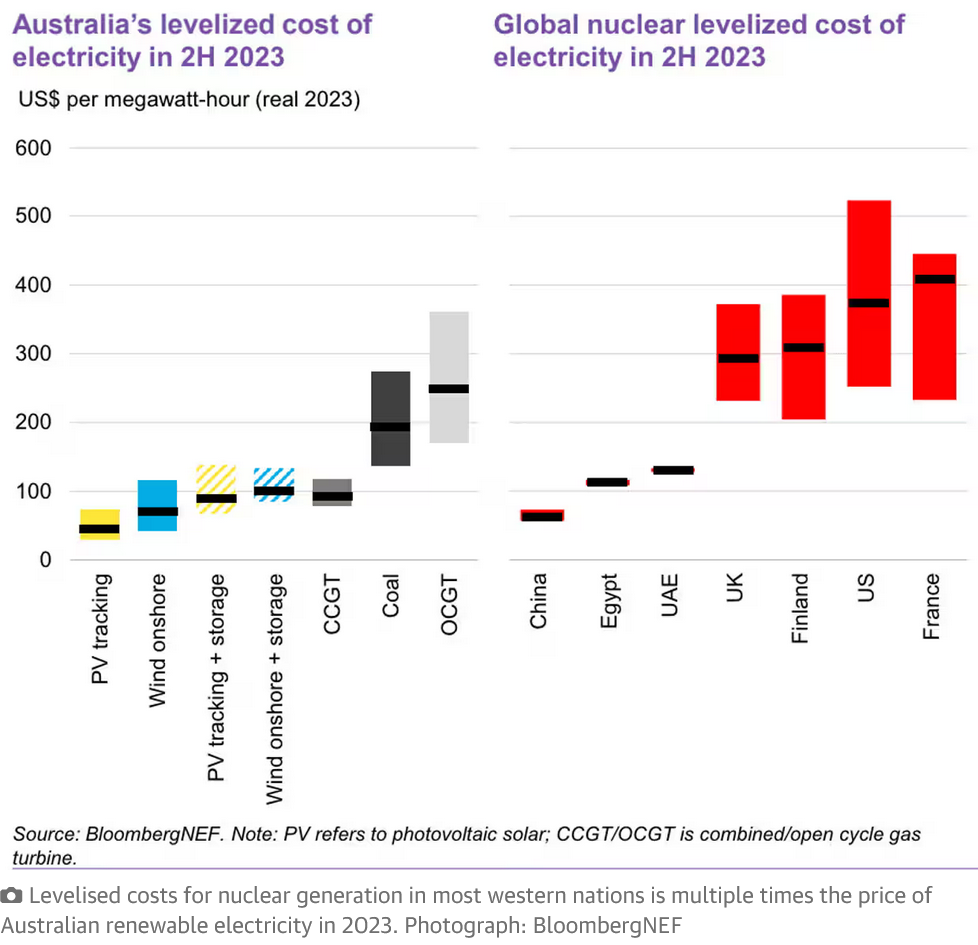

Even if they succeeded, the levelised cost of electricity – a standard industry measure – would be far higher for nuclear power than renewables. Taking existing nuclear industries in western nations into account, their cost would still be “at least four times greater than the average” for Australian wind and solar plants firmed up with storage today, Bloomberg said.

“Nuclear could play a valuable, if expensive, role in Australia’s future power mix,” the report said. “However, if the debate serves as a distraction from scaling-up policy support for renewable energy investment, it will sound the death knell for its decarbonisation ambitions – the only reason for Australia to consider going nuclear in the first place.”

Bloomberg’s analysis complements CSIRO’s GenCost report that also found nuclear energy to be far more costly than zero-carbon alternatives. Australia’s lack of experience with the industry would result in a learning “premium” that would double the price of the first nuclear plant, according to the CSIRO.

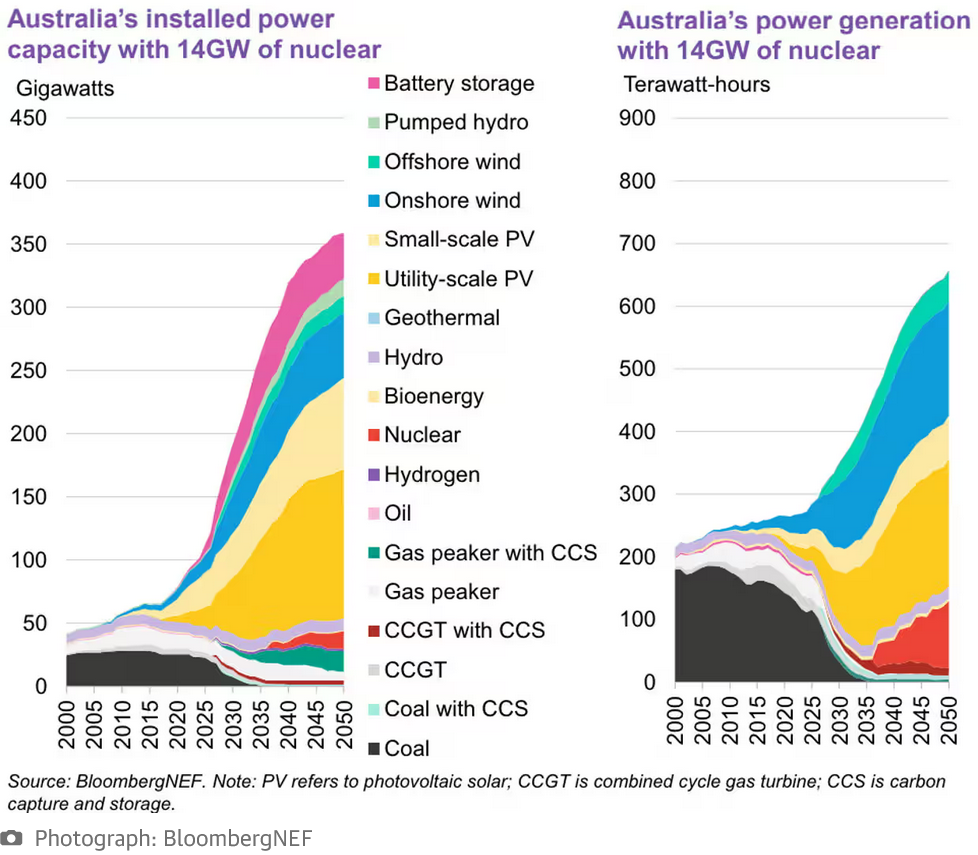

Bloomberg also found that assuming the opposition’s seven plants had a generation capacity of 14 gigawatts, they would supply only a fraction of the total market

If governments tried to rely on inflexible generators – whether coal-fired or nuclear – as renewables increased, they would have to resort to subsidies and other market interventions at a cost to taxpayers, Bloomberg said.

“This report speaks for itself,” the energy minister, Chris Bowen, said. “It’s another example of experts confirming that nuclear energy is too slow, too expensive and too risky for Australia.

“The Albanese government’s plan is the only plan backed by experts to deliver clean, cheap, renewable power available 24/7, and get us to net zero by 2050.”

Guardian Australia sought comment from the opposition energy spokesperson, Ted O’Brien.

ANZ, meanwhile, expects residential electricity prices to begin to see big falls starting from next month as federal and state rebates take effect.

From 1 July, all households in Queensland get a $1,000 rebate, those in Western Australia the first of two $200 rebates and nationally the first of four $75 rebates from the federal government will arrive.

In the September quarter, ANZ estimates consumer prices will fall 0.7 percentage points, temporarily dampening overall inflation – assuming those rebates aren’t extended again.

The Australian Competition and Consumer Commission will also release its annual market inquiry report on Friday. It showed that without the federal government’s energy rebates in the May 2023 budget the median residential energy bill would have been 14%, or $46.64, higher across all regions.

All bills rose only 1% as consumers also used less electricity, it said.

The median small business customer bill fell 22% in Victoria, 13% in south-east Queensland, 3% in South Australia and 2% in New South Wales.

“This report shows that our efforts to take the sting out of energy prices are making a meaningful difference,” the treasurer, Jim Chalmers, said.

Those facing hardship in paying their electricity bills, however, rose by 19%, or 43,507, to 273,337, the ACCC said.

Power prices were among the items that picked up pace in May, helping the annual inflation rise to 4%, the Australian Bureau of Statistics said on Wednesday. Electricity prices were up 6.5% in the year to May, compared with April’s 4.2% increase.

Without the rebates, the annual gain would have been 14.5%, the ABS said.