Southern California Edison Contracts Mammoth Storage Portfolio to Replace Gas Plants.

One of the world’s largest single battery storage procurements will race to meet an August 2021 deadline

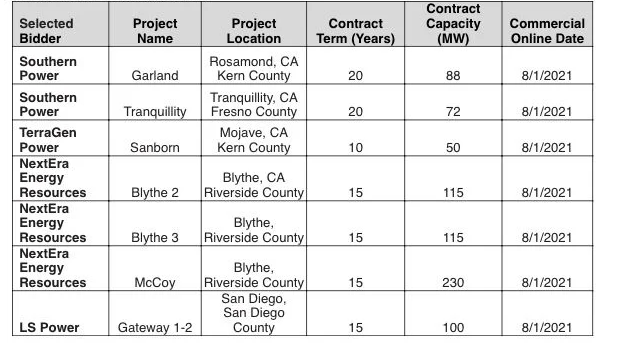

Southern California Edison has signed seven contracts for a combined 770 megawatts of grid battery projects, one of the biggest single procurements of its kind. The utility wants to switch them on by August 2021, which would be a record-fast turnaround for projects of that magnitude.

The seven energy storage projects, which still need approval from the California Public Utilities Commission, will help meet a fall CPUC order for 3.3 gigawatts of carbon-free resources to help meet the state’s grid reliability needs. Half of that solicitation is due online by August 2021, and SCE must deliver the largest share among the state’s utilities and community choice aggregators (CCAs).

Most of the winning projects will be co-located with existing solar farms that will charge the batteries, making them useful for integrating and smoothing the intermittency of the state’s growing share of renewable generation, as well as providing resource adequacy (RA) for times of peak demand in the late afternoons and evenings. That’s needed to replace grid capacity provided by four natural gas-fired power plants on the Southern California coast that use seawater for cooling, and have been ordered to close as soon as possible to reduce their environmental impact.

SCE's single 770-megawatt procurement "tops the entire 2019 U.S. storage market by more than 200 megawatts," said Daniel Finn-Foley, head of energy storage for Wood Mackenzie Power & Renewables. The consultancy expects the U.S. storage market to grow by more than 7 times from 2019 to 2021.

"The storage market is approaching a deployment acceleration over the next two years that will be unprecedented in recent U.S. electricity history," Finn-Foley said.

NextEra Energy Resources will build three of the SCE projects, which are also the largest of the seven selected by the utility. Those include a 230 megawatt/920 megawatt-hours project connected to NextEra’s 250-megawatt McCoy solar farm, and two projects of 115 megawatts/460 megawatt-hours apiece adjacent to NextEra’s two Blythe Solar Energy Center solar farms. All are located in Riverside County.

The McCoy storage project is among the largest being developed by NextEra, just behind its 250-megawatt/1 gigawatt-hour system connected to its 250-megawatt Sonoran Energy Center in Arizona. It’s also the second-largest being built in California, behind the 300-megawatt/1.2 gigawatt-hour Moss Landing project to be built by Vistra Energy for Pacific Gas & Electric. NextEra, North America’s leading wind and solar generator, has been seeking opportunities to add storage to its existing renewables fleet to take advantage of the falling battery costs.

Southern Power, a subsidiary of U.S. utility Southern Company, will develop two projects in California’s Central Valley connected to solar farms owned by Canadian Solar subsidiary Recurrent Energy: the 88-megawat/352 megawatt-hour Garland project connected to a 200-megawatt solar farm in Kern County, and the 72 megawatt/288 megawatt-hour Tranquility project connected to a 200-megawatt solar farm in Fresno County.

The final project is TerraGen Power’s 50-megawatt/200 megawatt-hour Sanborn project in the Mojave Desert. That project will be interconnected with a solar project now in development by Sanborn Solar, meant to provide 300 megawatts of solar generation and up to 3 gigawatt-hours of storage capacity.

The sole project that won’t be interconnected with existing solar is LS Power’s 100-megawatt/400 megawatt-hour Gateway 1-2 battery system in San Diego County. LS Power has also developed the 40-megawatt Vista battery project in Southern California, and is developing plans for up to 250 megawatts of energy storage at the Gateway site.

The unprecedented projects are facing a tight deadline to line up financing, order batteries and other specialized equipment, complete construction and start providing capacity to the grid by SCE’s stated completion date of August 1, 2021. The California Energy Storage Association (CESA) and storage companies are asking the CPUC for permission to expedite the process for reviewing and approving the projects, warning they might fail to secure financing without it.

Massive battery farms are expected to become an increasingly central asset for California’s grid as the state pushes toward its goal of getting 100 percent of its energy from carbon-free resources by 2045. SCE’s “Pathway 2045” roadmap for hitting that goal envisions about $170 billion of investment in clean energy generation and energy storage by 2045, and up to $75 billion more for grid upgrades to accommodate the shift to electrifying power transportation, heating and other sectors now reliant on fossil fuels.

Other large-scale projects announced in California in the past year include the 100-megawatt/400 megawatt-hour system being built by sPower for Clean Power Alliance, a community choice aggregator serving the greater Los Angeles area, and up to 300 megawatts/1.2 gigawatt-hours of storage being built alongside 400 megawatts of solar power being built by 8Minute Energy for municipal utility Los Angeles Department of Water & Power.

Finn-Foley noted that these projects represent "a perfect lesson in the flexibility of energy storage’s value. PG&E’s Moss Landing procurement plans to use stand-alone storage to target a transmission-constrained area," while LADWP and SCE are both seeking storage to allow for the possibilty of closing the coastal natural gas plants, he said.

Still, "the SCE procurement is unique so far in California — both massive in scale and scattered throughout four counties across SCE’s sprawling territory to target local system needs."

1 May 2020

gtm