Sustainable Investing: 10 Principles to Weed Out ‘Ill-Governed’ Companies.

Investors want sustainable investments, but what are the criteria? The United Nations has guidance.

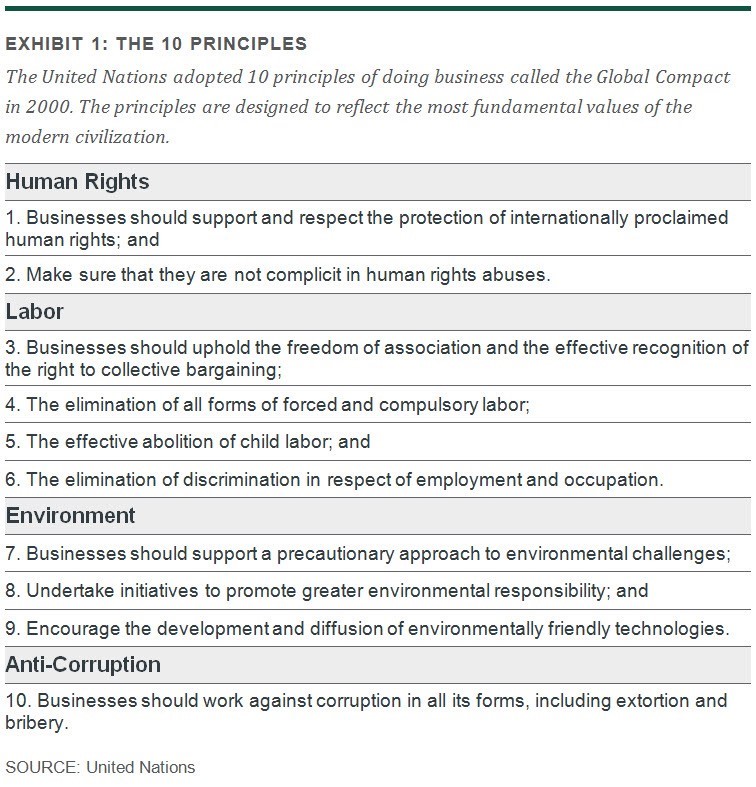

The United Nations Global Compact is a series of principles (Exhibit 1) that have become a universal standard for good business. Approximately 9,800 companies from 164 countries, representing nearly every sector and size, have committed to supporting the principles. Investors increasingly see compliance to the Global Compact as an indicator of the base level of sustainability and risks in their investments.

Easy to Implement, Easy to Explain

United Nations Global Compact screening has become the most common exclusionary screen for sustainable and ESG (environmental, social and governance) investment strategies, especially in Europe. The principles are part of STOXX Global ESG Leaders, STOXX Global ESG Impact, and Solactive L&G ESG index families. Indirectly, via controversy scores, the Global Compact is also included in MSCI ESG Leaders and SRI indexes.

Investors achieve at least two things with this approach: ethical well-being and avoidance of reputational risks. Divesting a company that is involved with violations of labor standards that may lead into ecological catastrophes, corruption or human rights related scandals allows investors to feel better. Many investors find this approach consistent with their investment philosophy. It is also easy to implement and explain to beneficiaries. And it can be easily combined with other investment tools, such as ethical exclusions of specific business activities.

Compliance with the Global Compact: Spotting the `Fails’

Compliance with the 10 principles means integrating sustainability into business operations and relationships, allowing for greater transparency, accountability and inclusiveness. More than 90% of companies that have joined the Global Compact have policies and practices in place for all 10 principles; particularly high levels of compliance are recorded on human rights and anti-corruption, according to a United Nations Global Compact progress report in 2017. However, only 58% of them conduct impact assessment on environmental compliance, 31% on labor, 22% on anti-corruption and 15% on human rights.

In practice, investors would assume a company is compliant if there is no evidence of violations. The decision on either “fail” or “pass” involves judgement call on a wide range of sensitive behavioral issues and the severity of their impacts.

For example, MSCI ESG research defines global norms violations as the most severe type of ESG controversies related to the four Global Compact themes (human rights, labor, environment, bribery and corruption), where there are credible allegations that the company or its management inflicted serious large scale harm through a disregard of the law or international norms of behavior. The “fail” signal is applied to such cases that are either ongoing or concluded within the last three years.

We manage about $11.6 billion using the Global Compact principles and are among the first to use them. But we apply even more conservative compliance criteria, where any red flag (existence of very severe controversies) in the four categories is assessed as a “fail.” One of the differentiating examples would be the well-documented fraudulent activity of Wells Fargo, which is not assessed as non-compliance by MSCI. However, under our more strict criteria, it is non-compliance.

Exclusion in Practice

Our custom ESG equity index funds, which recently had their five-year anniversary, apply the Global Compact screen along with other screens, including controversial weapons and tobacco. In emerging markets, they also have corporate governance screens.

Because of the MSCI’s policy to maintain the “fail” signal for at least three years, the list of Global Compact based exclusions is relatively stable over time. It currently screens out 14 companies in World Custom ESG Index and also 14 in the EM Custom ESG Index. A few changes have happened. In the second quarter of 2018, Novartis got added to the world exclusions list due to a corruption scandal in Greece. NTPC got added to the emerging markets exclusions list for labor rights controversies. Also, Gail India was deleted from the emerging markets exclusions list because its allegations on human rights controversies have been resolved.

We observe that the exclusions don’t significantly affect performance. Exclusions in our strategies have amounted to 2.5%-3.5% of assets and Global Compact-related tracking errors from standard benchmarks have stayed below 0.3% in developed markets 0.5% in emerging markets.

You Don’t Always Have to Take the Loss First

Of course, exclusions mean sell, but selling a company stock after the controversy event already happened and the stock price fell usually means fixing a loss. Clearly, there is no economic benefit, as the stock price may come back to the same or nearly the same level.

There is one important consideration though. Severe controversies can come as a result of poor risk controls, strategic vision and corporate governance, which can lead to improper behavior.

An example is the emissions scandal in September 2015 at Volkswagen, where risk management and governance were weak. ESG expert groups such as Vigeo and MSCI claim they have pointed out governance weaknesses prior to the scandal. For example MSCI’s corporate governance score of Volkswagen was in the 28th percentile (100th percentile having the highest governance score) and falling since 2014. The fact that governance risks materialized in the 2015 scandal proves embedded weaknesses and does not suggest that they are going away soon. To this point, Volkswagen still has highly concentrated ownership structure and a board with minimal independence, diversity and technical expertise.

Analyzing and Understanding Your Risks

The Global Compact screen strengthens the focus on governance and corporate culture for any sustainability strategy, based on the understanding that deficiencies foreshadow future corporate behavior. This can come in the form of lack of transparency, management accountability and financial prudence along with the inability to pick up strategic opportunities. In this sense, investors can see exclusion of ill-governed companies as a longer-term risk management tool.

Learn more about sustainable investing at Northern Trust Asset Management.

Disclosure:

IMPORTANT INFORMATION. The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. Northern Trust and its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, and its accuracy and completeness are not guaranteed. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Opinions and forecasts discussed are those of the author, do not necessarily reflect the views of Northern Trust and are subject to change without notice.

This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

Past performance is no guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by Northern Trust. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise.

Forward-looking statements and assumptions are Northern Trust’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc. Northern Trust Global Investments Limited, Northern Trust Global Investments Japan, K.K, NT Global Advisors Inc., 50 South Capital Advisors, LLC and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

26 April 2019