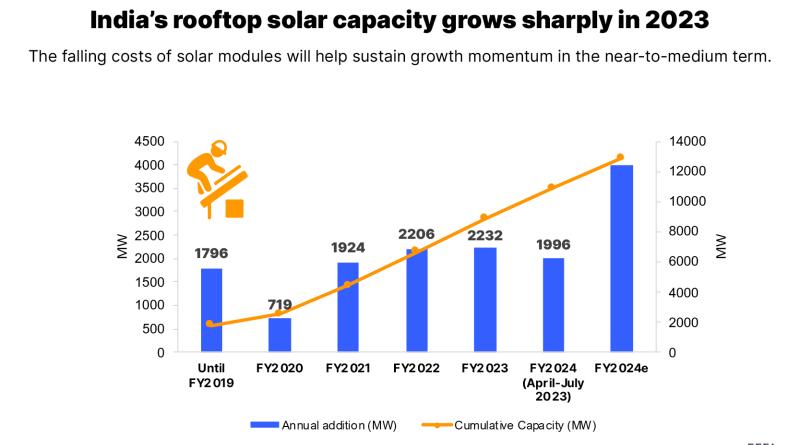

Record-high 4GW of rooftop solar capacity set to come in India in fiscal year 2024

Despite major roadblocks, rooftop solar capacity additions in the country are growing fast, with nearly 2 gigawatts (GW) already added in April-July 2023.

India’s rooftop solar market is bubbling with new energy, overcoming major roadblocks to likely add a record-high 4 gigawatts (GW) of capacity in fiscal year (FY) 2024, a new joint report by the Institute for Energy Economics and Financial Analysis and JMK Research & Analytics finds.

The report finds that the capacity addition between April and July 2023 was nearly 2GW, slightly less than the amount added in FY2023. Falling solar module costs will likely help sustain the growth momentum in the near-to-medium term.

“For India to attain its target of 500GW of renewable energy by 2030, solar and its verticals (including utility-scale, rooftop solar and open access) will all have to play a crucial role,” says the report’s co-author Vibhuti Garg, Director, South Asia, IEEFA.

“As countries like Germany and Australia demonstrate, with the right policy and regulatory environment, rooftop solar can be a game changer for greening the overall national energy mix.”

Despite the recent growth, the report finds that the rooftop solar market faces significant regulatory challenges.

“Regulatory uncertainties and lack of support from local electricity distribution companies (DISCOMs) have forced prominent developers to either focus on other segments or exit the rooftop solar business altogether,” says co-author Jyoti Gulia, Founder, JMK Research.

Gujarat, Andhra Pradesh Telangana, and the union territory of Delhi have the most favourable ecosystems for commercial & industrial (C&I) customers setting up rooftop solar projects. But, several other states need to push rooftop solar.

“Several states are moving away from net metering to lesser beneficial gross metering and net billing arrangements. This has led to C&I consumers shifting focus to other greening options, such as open access,” says co-author Kapil Gupta, Manager, JMK Research.

“The Green Open Access Rules, 2022 gave smaller C&I consumers access to off-site solar power. Going forward, consumers will prefer off-site open access, especially in states like Uttar Pradesh and Tamil Nadu with net metering restrictions for C&I consumers,” he adds.

The report recommends that policymakers consider creating separate renewable purchase obligations for rooftop solar to boost the market. States should also allow behind-the-meter rooftop solar systems as they can help DISCOMs forecast their load schedule. Finally, the central government should issue uniform regulatory provisions, similar to the Green Open Access Rules.

Meanwhile, the micro, small and medium enterprises (MSME) segment has emerged as a potential growth area for rooftop solar. In recent years, rooftop solar financing for MSMEs has improved as lenders realise the segment’s potential and develop products tailored to its needs.

This year, the World Bank will likely approve and announce a credit guarantee mechanism, with a US$100 million payment guarantee fund covering up to 50% of the debt financing amount from participating financial institutions to a grid-connected rooftop solar project. The scheme will likely give a fresh impetus to financing for MSME rooftop solar projects.

“Given the emerging financing avenues, we believe the next phase of growth in the rooftop solar market will come from this segment,” says co-author Prabhakar Sharma, Consultant, JMK Research.

The report recommends strictly enforcing solar procurement targets for accelerating rooftop solutions with MSMEs.

The report also finds that adopting battery energy storage systems (BESS), virtual net metering and peer-to-peer trading will boost the rooftop solar market. “As states start to adopt Time of Day pricing, coupling rooftop solar with BESS for C&I will increasingly make more economic sense,” says Gupta.

Further, the report highlights that innovative business models such as virtual net metering and P2P trading can benefit consumers and DISCOMs. “Through virtual net metering, consumers at different locations can aggregate and source rooftop solar power from a single, large solar plant. This increases the effective site availability suitable for deploying rooftop solar. It also gives such projects access to better financing terms,” says Sharma.

“In P2P trading, consumers in the same DISCOM jurisdiction can trade excess solar power. It is an alternative to net metering and allows energy consumers to become energy prosumers. For DISCOMs, it reduces distribution losses and excess solar power purchases and offers a potential new revenue stream through charges and fees for energy traded in P2P,” he adds.

Read the report: The Rooftop Solar Commercial & Industrial Market in India