Global investors are moving away from the massive climate-related risks associated with fossil fuels

Top debt and equity investors committed over $300 billion in 2020 into building renewable energy capacity

Despite the economic disruption from COVID-19, top global debt and equity investors are continuing to drive capital into the renewable energy infrastructure sector due to its consistency in providing investment opportunities, finds a new report from the Institute for Energy Economics and Financial Analysis (IEEFA).

“Global investors are accelerating their collective move away from the massive climate-related risks associated with fossil fuel assets and building capacity so as to increasingly deploy huge amounts of capital into renewable energy infrastructure projects,” says report co-author and IEEFA’s Director of Energy Finance Studies, Australia/South Asia, Tim Buckley.

“The continued expansion of investment shows the resilience of the renewable energy sector despite the economic disruption of the COVID-19 pandemic.”

IEEFA’s report highlights the top debt and equity investors providing the funds to drive decarbonisation, as well as showcasing some of the biggest deals in the renewable energy sector.

Top 10 debt investors

This report lists 10 global commercial banks, selected from BNEF’s Clean Energy League Table ranking, which together lent US$30bn to renewable energy projects in 2020.

A key feature is the recently increased profile of Asia, with three Japanese banks (Sumitomo Mitsui Banking Corporation Group; Mitsubishi UFJ Financial Group Inc; and Mizuho Financial Group Inc), but we note the list is still clearly dominated by European banks (Banco Santander; CaixaBank; BNP Paribas; Societe Generale; Cooperative Rabobank; Credit Agricole Group; and ING Groep).

This report outlines how the banks’ investment trends are starting to pivot into clean energy assets, and we highlight key recent renewable energy transactions that show the growing investment diversity in terms of technologies and geographies.

Leading global banks are ramping up on delivery of their commitment towards reduced fossil fuel exposure, building momentum in order to start to align with the exceptionally ambitious pledges of the 1.5°C goal under the Glasgow Net Zero Banking Alliance announced in April 2021.

This is a massive step-change in ambition by these financial institutions, which have a combined worth of more than US$88 trillion in assets, to advance the Paris Agreement’s decarbonisation goals, says report co-author and IEEFA Research Analyst Saurabh Trivedi.

“U.S. banks are conspicuous by their absence from our list of debt investors, having only recently started to join the global movement of investment into climate-focused sectors,” says Trivedi.

“Debt investment by large banks will be critical to achieving the Paris goals given that they own assets worth of hundreds of trillions of dollars.” Typically, infrastructure projects also require a larger component of debt capital (60-80%) compared to equity capital (20-40%).

Top 10 equity investors

The authors selected 10 global equity investor leaders for their proven track record in renewable energy investment and the commitment of their top management to mobilising finance to combat climate change.

The leading renewable energy equity investors are a diverse set of financial institutions, including asset management giants Amundi, BlackRock and Brookfield, pension funds, infrastructure investment funds, private equity investment firms and diversified financial groups.

“The two pension funds in our list, Canadian pension funds CPPIB and CDPQ, both have significant investment in renewable energy infrastructure across geographies,” says Trivedi.

“We also include a few smaller infrastructure funds such as Cubico Sustainable Investments and Global Infrastructure Partners, because in contrast to many other larger funds, they are aggressively investing in the sector including in greenfield renewable energy investment, which demonstrates the risk-taking and capacity building of these funds as well as their commitment to climate goals.”

Top 10 global renewables deals

The report also highlights 10 globally significant renewable energy infrastructure projects.

“Strong risk-adjusted return prospects and stable project cashflows, along with green economic stimulus packages, particularly from Europe, have helped to drive solar energy installation and a US$50bn surge in offshore wind power projects,” says Buckley.

“Last year we saw the financing of the two largest renewables projects to date, the 3.6GW Dogger Bank offshore North Sea wind farm and the 2GW TAQA Al Dhafrah in the United Arab Emirates.

“These mammoth projects require investment on a staggering scale and we’re seeing global investors racing to deploy capital into the growing opportunities of the energy transition, which will grow into a multi-trillion dollar annual investment opportunity if the world is to deliver on its climate goals.”

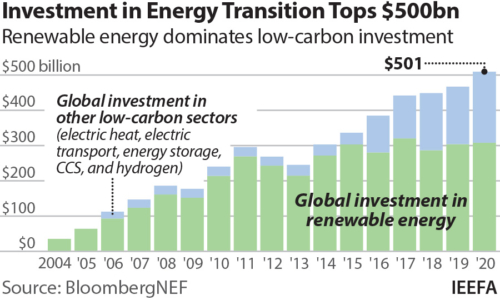

Global investors committed a record US$501 billion to renewables, energy storage, electric vehicle infrastructure, hydrogen production, heat pumps and other low-carbon assets in 2020, according to BloombergNEF (BNEF) data. This was a 9% increase on the previous year and the first time that annual energy transition investment passed the half a trillion-dollar mark.

Annual investment in renewable infrastructure in 2020 increased 2% to US$303 billion, or 60% of total investment in low-carbon energy transition assets last year, BNEF found. The electric transport and allied charging infrastructure sector received the second biggest portion of investment in 2020, at US$139bn (28% higher than in 2019).

Read the report: Global Investors Move into Renewable Infrastructure

Media contact: Rosamond Hutt (rhutt@ieefa.org) +61 406 676 318

Author contacts: Tim Buckley (tbuckley@ieefa.org); Saurabh Trivedi (strivedi@ieefa.org)

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)

19 July 2021

IEEFA