Financial Times: The $900bn cost of ‘stranded energy assets’

Climate targets may force energy groups to leave huge reserves of coal, oil and gas in the ground

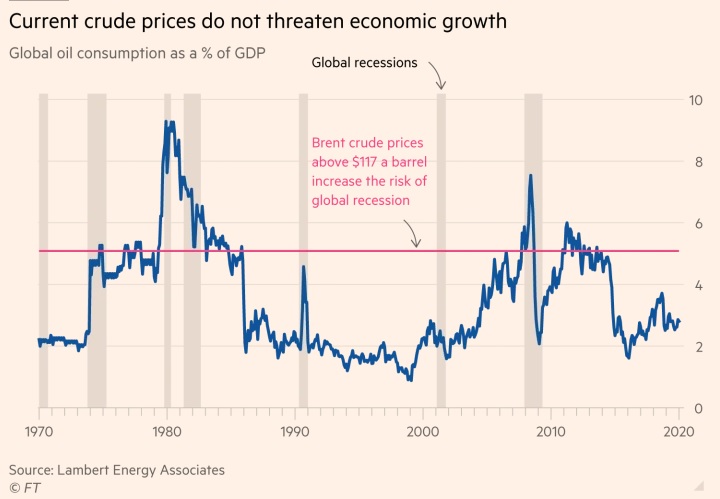

Donald Trump was thinking about the teenage climate activist Greta Thunberg when he took aim at what he called the “prophets of doom” at Davos in January. But just as easily he could have been targeting global investors whose trenchant criticism of hydrocarbons has led to a shift in investment away from the traditional energy sector and into renewables. This move represents a big problem for energy groups such as Exxon, BP and Saudi Aramco. Vast swaths of their oil, gas and coal reserves may never be extracted and burnt because doing so would intensify global warming, worsening freak weather events and threatening the loss of farmland and huge population displacement. That could leave them with large numbers of what are known as “stranded assets”.

In that context of the climate emergency, the cost of writing off stranded assets could be seen as a small price to pay. But the amounts involved would be breathtaking. According to Lex estimates, around $900bn — or one-third of the current value of big oil and gas companies — would evaporate if governments more aggressively attempted to restrict the rise in temperatures to 1.5C above pre-industrial levels for the rest of this century. Even in what the industry might see as the more benign case of a 2C rise — which was the target countries agreed to meet at the 2015 Paris Agreement on climate change — energy producers, including coal miners, would have to write off over half of their fossil fuel reserves as stranded. If the 1.5C threshold were to be met then the pain would be greater, leaving over 80 per cent of hydrocarbon assets worthless.

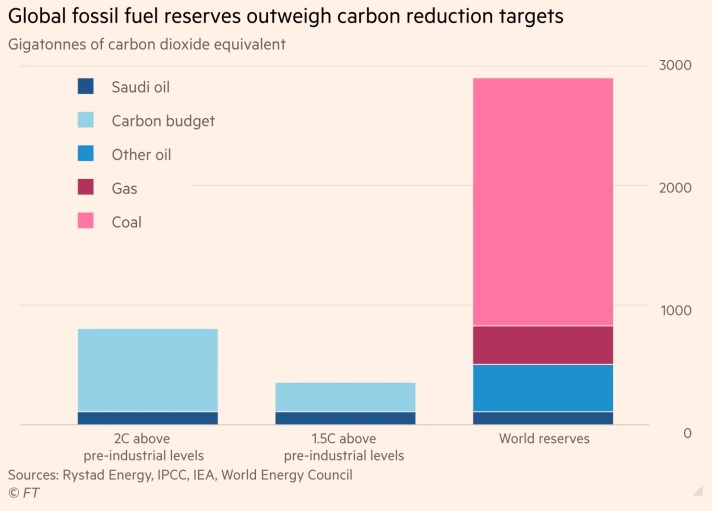

Carbon emissions were once thought of as a costless “externality” by business. But as evidence of climate change has mounted and public opinion shifted, energy companies have begun to look at the real financial consequences. This has been most notable in the rising cost of capital for hydrocarbons groups and ever-cheaper money for renewables. After much hand-wringing, BlackRock, the world’s largest investment manager, signed up to the Climate Action 100+ initiative, a group of 370 fund managers controlling some $35tn of assets. These investors want action on greenhouse gases, and energy producers with large stores of hydrocarbon reserves are an obvious target. These companies have 2,910 gigatonnes (GT) of potential CO2 emissions locked away in their assets. Two-thirds of that is coal, the rest crude oil and natural gas. The question investors must ask is how long these assets can hold their value. Ben Caldecott, director of Oxford university’s Sustainable Finance Programme, says: “Oil companies need to think about [preparing] themselves for when their cost of capital soars.”

That cost has already begun to rise. Most international oil companies, and some national ones, have shares and bonds trading on the capital markets. The share prices of oil, gas and coal producers have lower valuations than five years ago. The threat is clear: hundreds of billions of dollars of value could be lost. NOCs, many of which have much more oil and gas in reserves than they can produce in a generation, face even greater risks regardless of their relationship with the capital markets. On the assumption that the commitments made at the Paris climate conference hold, global warming must be kept to an additional 2C. Pursuing an even tougher target of 1.5C may well be necessary to put a brake on global warming, say climate change experts. According to academics at Duke University in the US, since the pre-industrial period human activities have increased Earth’s global average temperature by about 1C. This number is rising by 0.2C every decade. At that rate, global warming is likely to reach 1.5C above pre-industrial levels sometime between 2030 and 2052, with a best estimate of around 2040.

The International Energy Agency defines stranded assets as “those investments which have already been made but which, at some time prior to the end of their economic life, are no longer able to earn an economic return”. These investments may involve the purchase of rights to explore in a given area, or assets with infrastructure in place actually producing hydrocarbons. Switching decisively away from fossil fuels will be hard. The Paris agreement set carbon budgets — allowable amounts of emissions — that would permit a certain amount of global warming. This was done on the assumption that expecting economic activity to halt abruptly was not reasonable, or even acceptable, to many countries. Assuming a 50 per cent chance of meeting the 2C warming limit by the end of the century, the UN Intergovernmental Panel on Climate Change set out a carbon budget of 1,200 GT for fossil fuels which could be burnt by the year 2100. To meet the tougher 1.5C limit, only 464GT would be allowed, far below the equivalent of 2,910 GT of CO2 held in the remaining oil, gas and coal assets, according to Bernstein Research. Last year about 33GT of carbon emissions were released according to the IEA. How quickly emission levels rise depends on factors ranging from population growth to macroeconomic activity. The increased take-up of non-fossil fuels for energy will also have an impact.

The various carbon budgets give some sense of just how much is at risk for energy producers, including the state-owned energy companies. In the best case for them, a rise of 3C, almost all of the remaining carbon stock — 96 per cent — could be burnt. But at the lower bound of 1.5C, using the IPCC allowance, a mere 16 per cent of the carbon is usable. In other words, over 80 per cent of carbon in the ground would be stranded and theoretically worthless. Even at 2C, 59 per cent of fossil fuel reserves would be stranded.

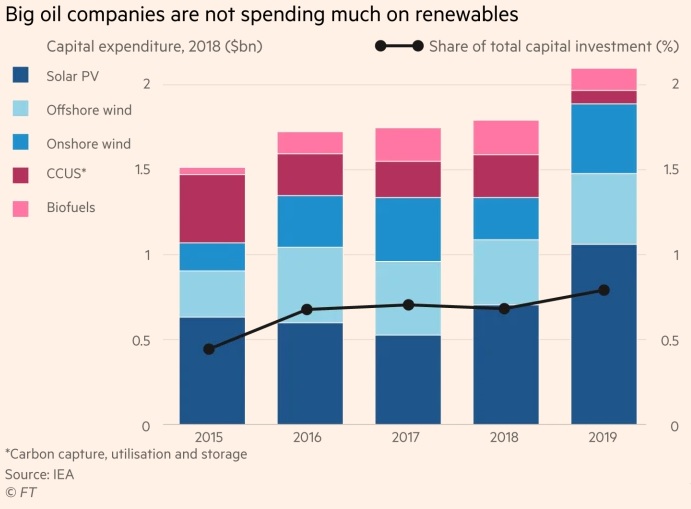

Most IOCs understand the threats ahead, even if they do not all appear to have accepted how much action is needed to solve the problem of excess carbon emissions. Some of the largest, such as Total of France and Royal Dutch Shell, have invested in renewable energy projects ranging from solar power to biofuels. But the proportion of total capital expenditure by the largest oil and gas companies, going to low carbon businesses, represents less than 1 per cent of investment, says the IEA. For the most part these are consumer-facing retail businesses which many IOCs should be comfortable with. “Exxon and Shell both started out in the refining and marketing of fuels,” says Martijn Rats at Morgan Stanley. “The IOCs understand branding, the NOCs not so much.” Can oil companies reinvent themselves? Denmark’s Orsted, previously DONG Energy, has become a wind farm specialist. Of the larger oil companies, Neil Beveridge at Bernstein can only think of one that has done so. India’s Reliance Industries has shifted its focus away from oil refining towards telecoms and online retailing.

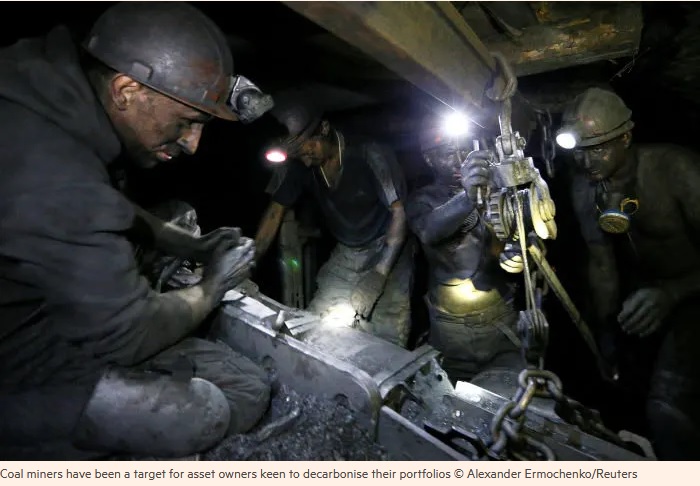

To assess how much shareholder value is at risk, both the reserves under threat and the type of fuel involved must be considered. Coal accounts for two-thirds of potential carbon emissions held in reserve. There is a lot of it in the ground and it contains the largest proportion of carbon of the fossil fuels, according to the IEA. By weight, coal on average holds half again as much carbon as crude oil and twice that of natural gas. In a 2C scenario, less than a quarter of coal reserves could be burnt, the rest stranded. Stock markets have priced in this likelihood. So to get a glimpse of what could happen to oil and gas producers unwilling or unable to do something about their collective impact on emissions, look at the share prices and valuation of coal mining groups such as Peabody Energy and Yancoal Australia.

As the first target for asset owners keen to decarbonise their portfolios, coal miners have performed disastrously over the past decade. Bloomberg’s index of global coal miners, the largest of which are in China, has plunged 74 per cent from its peak in early 2011. These miners have become “value traps”, trading cheaply but without any obvious incentives to attract investors. That drop adds up to $300bn of market value for these 30 or so coal miners. Using the same 2C scenario, much of the world’s oil (71 per cent) and gas (92 per cent) reserves could be burnt. That suggests relatively little economic impact on the producers. The market has made the distinction from coal. Of course, it is fair to say that cheap US natural gas, trading near 10-year lows, has also put pressure on thermal coal prices in that region. Collectively, world oil and gas company market values have fallen about half as much as coal miners since their own decade peak in 2011.

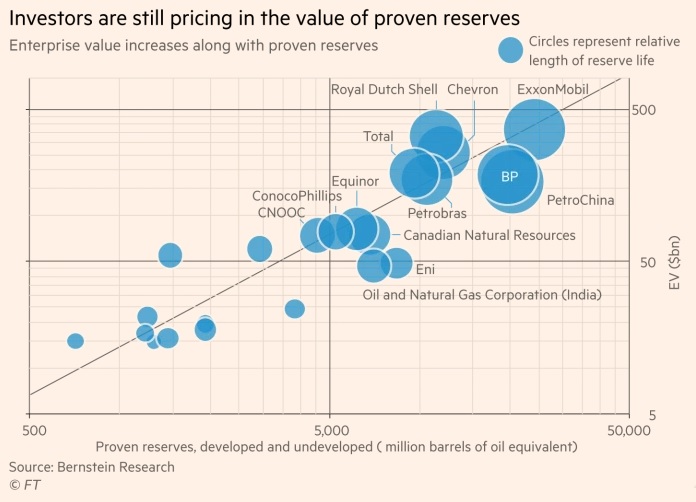

Calculating the value of these stranded reserves involves asking not just which warming scenario to use, but also making a stab at how stock markets value reserves generally. Putting natural gas specialists aside, stock markets have traditionally attributed a higher worth to companies with greater amounts of oil reserves. For the largest listed oil companies, there is a positive relationship between enterprise value (market capitalisation plus net debt) and their reported proven reserves, for assets with the highest probability of development.

On the basis of this relationship and assuming a 2C scenario, that would leave 29 per cent of oil reserves stranded and wipe off about $360bn in value of the top 13 IOCs by reserves. That is well over a sixth of their total enterprise value. But to meet the stricter warming target of 1.5C then that figure would more than double to nearly $890bn. Separate estimates for the value of these oil assets from Rystad Energy, which depend on very long-term oil prices, would lessen the impact. But the decline would still be significant. Given that these producers have lost roughly $400bn in market value over the past three years, it is fair to assume that they could survive such a drop. However, should policymakers, driven by public fears about the environment, push climate change to the fore these declines may accelerate. A sudden drop in asset value could bring a disorderly decline for all oil and gas stocks. Those companies with the highest carbon intensity in their oil and gas reserves face the greatest risk of writedowns as a result of changes in climate change policy. These include Canadian oil sands producers Suncor Energy and Imperial Oil, but also US shale oil drillers Pioneer and EOG.

The oil and gas producers exposed to the biggest potential hits are those that will need the longest time to use up their reserves. This is known as reserve life. If you focus on the groups with high carbon intensity and long reserve lives — those with the most to lose — the names that appear are Rosneft, ExxonMobil, PetroChina and BP, according to Bernstein Research.

That leaves the NOCs, the largest overseers of hydrocarbons. A number of countries, particularly within the Opec cartel, have very long reserve lives. They produce crude relatively slowly compared with what they have. About 71 per cent of the oil in the ground belongs to these countries, from Iran to Iraq and Venezuela. While the 50 largest listed international oil companies have sufficient oil and gas assets to last them for between 10 and 20 years, these countries on average would need 68 years to exhaust their supplies. A breakdown of the world’s oil and gas production into a top 50 reveals that 35 per cent is controlled by international groups, and the rest by national organisations. Use those percentages on the allowable carbon budgets, and it is clear that state-controlled producers have a lot more to lose. In a 2C scenario, applying the 65 per cent for NOCs to a carbon budget of 433GT leaves 281GT for country producers. But that means nearly half of sovereign oil reserves would remain in the ground.

Of course, any NOC depends on its sovereign state and vice versa. Adopting carbon friendly policies may not suit countries such as Venezuela or Nigeria which depend so much on oil and gas for government revenues, but suffer less pressure to change their behaviour from the investment community. Following its listing of Saudi Aramco, that would be less true for Saudi Arabia. Markets will price in the risk of asset writedowns by the world’s oil and gas companies. That may happen gradually, but unless a solution is found for climate change in the coming decade, there is a risk of a sharp collapse in asset prices of IOCs, one that goes beyond the scenarios here. The greatest threat is faced by economies that have become dependent on oil and gas. However, the effects of writing off stranded assets would be felt across the business world. It would be one of the biggest ever shifts in the allocation of capital.