The last days of the Empire.

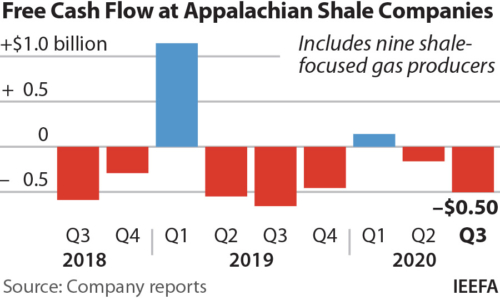

Appalachian frackers report $504M in negative free cash flow despite capex slashing

Tide of red ink shows little sign of ebbing any time soon for shale-focused regional gas producers

December 3, 2020 (IEEFA)—Even after cutting their capital expenditures (capex) by more than one-third from the previous year, nine shale-focused gas producers in Appalachia spent a half-billion dollars more during the third quarter on drilling and building projects than they earned from selling oil and gas.

Capex investments during the third quarter were the lowest in at least six years, according to an analysis by the Institute for Energy Economics and Financial Analysis (IEEFA). The analysis found eight of the nine frackers in the sample cut capital spending from the previous year’s level; Range Resources cut its quarterly capital costs to $72 million, a 60 percent reduction from the $178 million it spent during the third quarter of 2019. Only National Fuel increased capex during the quarter, primarily because it bought Shell’s dry gas assets in July.

The reduced capex investments have been one part of a two-pronged strategy that has barely kept some Appalachian frackers afloat as they struggle to survive weak demand and low prices. Several producers have resorted to financial hedging strategies in hopes of achieving positive free cash flows. EQT, which cut its quarterly capex by 40 percent from 2019 levels, reported making $252 million from commodity derivatives during the third quarter.

“The shale revolution has turned the U.S. into the world’s most prolific gas producer,” said Kathy Hipple, an IEEFA energy analyst and co-author of the briefing note. “Yet in financial terms, the gas production boom has been an unmitigated financial bust, with most fracking-focused companies, including major Appalachian gas companies, regularly reporting negative free cash flows.”

Other ominous signs were apparent. Besides Shell’s “fire sale” of its Appalachian assets, ExxonMobil appears likely to include some of its North American gas assets in a planned fourth-quarter impairment that could reach $20 billion. And while Henry Hub natural gas prices rose during the quarter, prices at the Dominion South hub—where Appalachian gas is often priced—were less than three-quarters of the Henry Hub price at the end of the quarter.

Appalachian gas producers also curbed gas output, but relief isn’t likely to arrive soon. The U.S. Energy Information Administration expects that gas consumption will be down by 2 percent this year and another 5 percent next year.

“Without a sustained price rebound and renewed capital investments, market watchers can expect Appalachian gas producers to continue to shrink, both in their gas output and in their financial health,” said Clark Williams-Derry, an IEEFA energy analyst and co-author of the note.

**********

Denmark, European Union’s largest oil producer, to phase out production by 2050

Denmark, the European Union’s biggest oil producer, will stop offering new licenses in the North Sea and phase out production altogether in 2050 as it takes an historic step toward a fossil-fuel free future.

Climate and Energy Minister Dan Jorgensen told reporters in Copenhagen that he expects the decision to “resonate around the world.”

The Social Democrat government reached an agreement with a majority in the parliament late on Thursday. The deal means a planned 8th licensing round will be abandoned, as will all future exploration, Jorgensen said. About 150 million barrels of oil and equivalents that would have been drilled by 2050 will remain beneath the ocean’s surface.

For oil and gas companies currently operating in Danish waters, terms and conditions will remain unchanged until production stops in 2050. The decision will cost Denmark about 13 billion kroner ($2.1 billion), according to estimates by the energy ministry.

For Denmark, the decision to end its North Sea exploration fits into an agenda that has made protecting the climate a priority. The country targets cutting carbon emissions by 70% in 2030, compared with 1990 levels.

Jorgensen pointed to Europe’s desire to be carbon neutral by 2050, “which means it needs to end its reliance on fossil fuels. It’s my clear impression that this development will speed up,” he said.

************

U.S. coal companies White Stallion and Lighthouse Resources file for bankruptcy

Two more U.S. coal mining companies have filed for bankruptcy as producers across the country struggle to sell coal into the troubled thermal coal market.

White Stallion Energy LLC and Lighthouse Resources Inc. filed voluntary petitions for Chapter 11 bankruptcy in the U.S. Bankruptcy Court for the District of Delaware on Dec. 2 and Dec. 3, respectively. Both companies are looking to sell their assets through a bankruptcy reorganization sale process. Each reported estimated assets of between $100 million and $500 million with liabilities in the same range.

Lighthouse, which is headquartered in Utah, operates the Decker mine in Montana and owns various other coal assets. Lighthouse produces low sulfur thermal coal with a focus on power generation markets in Asia. Decker produced 3.6 million tons of coal in 2019, according to U.S. Mine Safety and Health Administration data.

Lighthouse faced numerous legal and regulatory obstacles and public opposition in its attempt to develop the Millennium Bulk Terminals-Longview LLC property in Washington into a coal export facility. The effort, which has already taken over eight years, could have bolstered the company’s access to Asian coal demand as domestic appetite for the fuel has waned.

White Stallion was founded in 2010 to develop and operate surface mining complexes in Indiana and Illinois. It grew by acquiring coal companies and mines in the region, eventually reaching annual coal sales of 7 million tons and generating $26 million in EBITDA in 2019.

The company operates six surface mines producing thermal coal from the Illinois Basin. Its largest customer is Duke Energy Corp. subsidiary Duke Energy Indiana LLC, which accounted for 70% of the coal company’s cash receipts in the nine months leading up to the bankruptcy filing.

****************

Italian oil major Eni buys 20% stake in U.K.’s Dogger Bank offshore wind project

Italy’s Eni is buying a 20% stake in the Dogger Bank Wind Farm project from Norway’s Equinor and Britain’s SSE as it seeks to gain expertise in the sector and cut its greenhouse gas emissions 80% by 2050. The project off the northeast coast of England is expected to become the world’s largest offshore wind farm, helping the companies achieve their climate targets.

Eni’s investment in the development was for a combined 405 million pounds, the companies said on Friday.

“Entering the offshore wind market in Northern Europe is a great opportunity to gain further skills in the sector thanks to the collaboration with two of the industry’s leading companies,” Eni chief executive Claudio Descalzi said.

Along with many other oil majors Eni plans to massively increase its renewable power generation to reduce its reliance on fossil fuels and meet internal climate targets. It plans to have more than 55 gigawatts of renewable capacity by 2050, up from less than 1 GW in 2019. Eni has already formed a joint venture with Norway’s HitecVision to take part in an offshore wind power tender in Norway next year.

SSE and Equinor said they would each realise 200 million pounds from the Dogger Bank sale, which is expected to be completed in early 2021 subject to regulatory and lender approvals, while still holding a combined 80% stake.

“Once again, we have demonstrated Equinor’s ability to create value from renewables projects,” Paal Eitrheim, the company’s head of New Energy Solutions, said. Equinor also sold a 50% stake in two U.S. wind farms to BP in September, booking a $1 billion profit.

*******************

Dominion cancels plans for $200 million, 500MW gas peaking plant in Virginia

Dominion Power, which had hoped to invest about $200 million in a power plant at the Southern Virginia Megasite at Berry Hill, has canceled its plans at the site.

“We no longer believe it is possible to build the units planned in Pittsylvania County despite the economic and reliability benefits for our customers,” Dominion spokesperson Jeremy L. Slayton wrote in an email to the Danville Register & Bee on Thursday afternoon. “We plan to conduct a further reliability study to determine how best to move forward to maintain the around-the-clock service our customers need.”

The 500 megawatt, combustion turbine power plant, which would have been a total investment of more than $200 million, was projected to be the first business at the mega site, located in Pittsylvania County a few miles west of Danville.

The power plant — announced in November 2019 — would have been connected to the existing Transco natural gas pipeline that runs through the Berry Hill Megasite. It was to be a peaking station, only to be used during peak times where the renewable energy options can’t keep up with demand.

At full power, the plant would have provided enough power for 125,000 homes.

10 December 2020

IEEFA