How utilities can harness green hydrogen production's flexibility in balancing a high-renewables grid

This opinion piece is part of a series from Energy Innovation’s policy experts on advancing an affordable, resilient and clean energy system.

Green hydrogen, to the extent it is needed to reduce greenhouse gas emissions, is also a promising clean source of much-needed grid flexibility. It is a fungible energy carrier that is an essential ingredient to fertilizers and can also be burned for heat or turned into more stable liquid fuels and various feedstocks. When hydrogen is produced by electrolyzers that split water into oxygen and hydrogen using carbon-free electricity, it is labeled green (or clean).

Electrolyzers consuming electricity selectively to produce hydrogen makes commercial sense. If they do this by being responsive to prices or other incentives, they can play an important stabilizing role in a clean, reliable grid. This could also create a valuable feedback loop whereby demand for cheap electricity drives flexibility, in turn facilitating installation of new variable clean energy with positive reliability spillovers.

To sow and harvest this opportunity, energy producers and policymakers should eliminate barriers to smart pricing and facilitate transmission. As green hydrogen gains momentum, understanding its role as a demand-side resource will help achieve reliability in a high-renewables grid.

Recent interest in green hydrogen

On June 8, the Department of Energy announced a loan guarantee of $504.4 million for the Advanced Clean Energy Project (ACES) in Utah. The loan will “finance the construction of the largest clean hydrogen storage facility in the world, capable of providing long-term low-cost, seasonal energy storage.”

This follows President Joe Biden’s decision to use the Defense Production Act to support electrolyzer deployment, and $8 billion the 2021 infrastructure package earmarked for four or more hydrogen hubs. Strong federal interest could help green hydrogen cut power, transport, and industry emissions. But, more importantly, these projects could demonstrate green hydrogen’s role as flexible demand.

Located in Delta, Utah, the ACES project sits adjacent to the retiring coal-fired Intermountain Power Plant. ACES will use renewable energy to generate green hydrogen which will be stored in giant salt caverns, then burned in a turbine to provide clean power to Los Angeles on a 500-mile high-voltage direct current (HVDC) line, providing seasonal storage and peaking power by 2045.

Because using hydrogen for electricity storage is quite inefficient (the roundtrip efficiency from electricity to hydrogen back to electricity is only 30% to 40%), more affordable direct wind and solar electricity are likely to provide most of the replacement power for fossil electricity flowing through the HVDC line as Los Angeles cleans its grid, with stored hydrogen only sporadically burnt in a turbine to cover gaps.

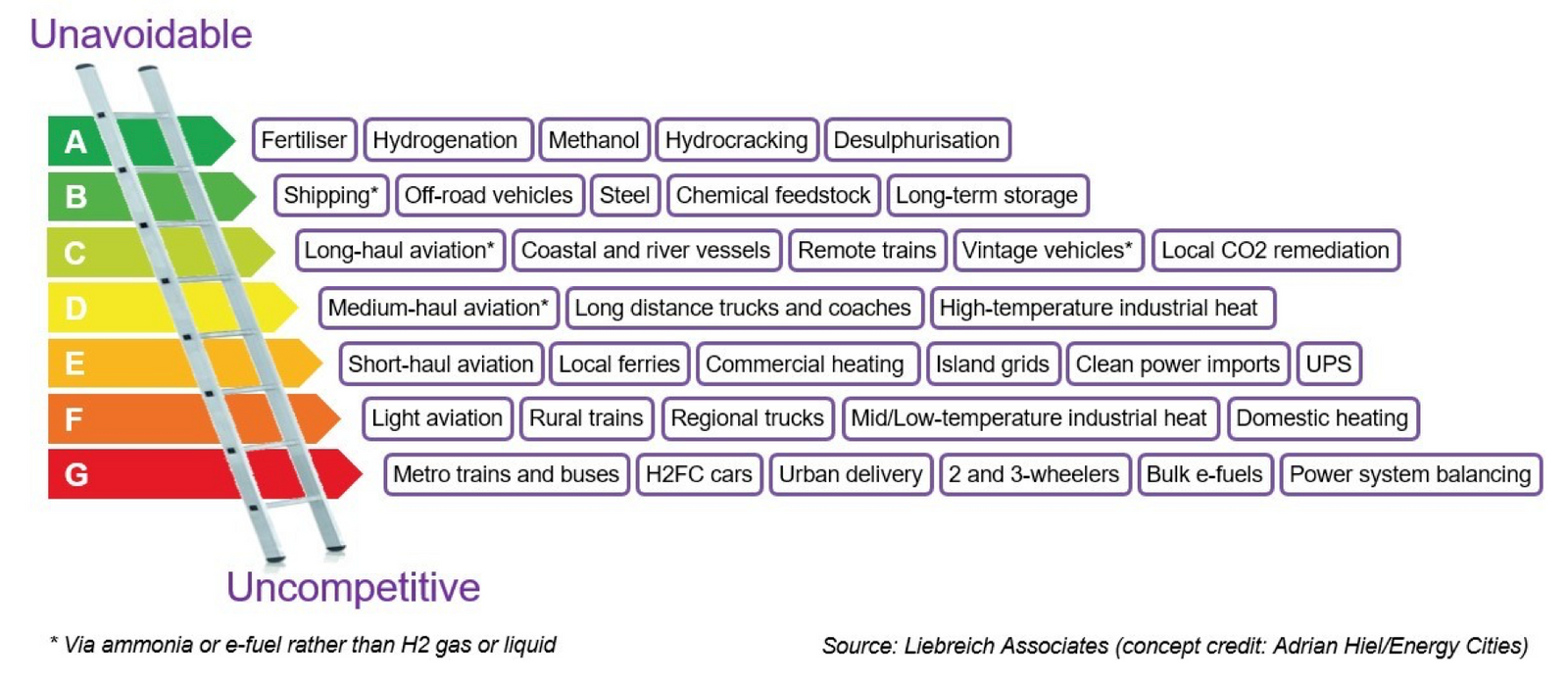

Using solely hydrogen as a principal replacement power source for Los Angeles (Intermountain currently provides the Los Angeles Department of Power and Water Resources with 16% of annual energy) makes no sense. There are reasons to be skeptical of alternative ideas to pipe it directly to LA instead. Rather, to understand how a project like ACES could succeed, consider clean energy consultant Michael Liebreich’s “Hydrogen Ladder,” which prioritizes various end-uses for clean hydrogen.

Permission granted by Energy Innovation

Even if the hydrogen from ACES fails to compete against other long-duration storage solutions or so-called “clean firm” resources as a backup source for Los Angeles, it can still potentially feed other applications on this ladder. In all cases, the ability of this flexible demand to modulate the flow of clean electricity on the HVDC line can be valuable for reliability.

The grid and market benefits of flexible hydrogen demand

Electrolyzers requiring large volumes of clean power can facilitate a cleaner, more affordable, more reliable grid if they are used judiciously. New renewable projects will need to be built to supply all this power, contributing to a cleaner grid. Variable renewable pairs well with electrolyzers because they can be opportunistic about consuming clean power when it’s available or reducing consumption when the grid needs it.

Wind and solar are starting to face headwinds from diminishing value as their penetration increases. New industries like hydrogen slow this trend: Renewable projects can sell power at a discount to the hydrogen hubs when demand is low, then sell power to utilities when demand is high. The net effect of additional demand from electrolyzers and additional supply from these incremental clean projects is a more reliable grid — the highest value energy from new renewable projects flows to the grid, while green hydrogen producers absorb the rest.

Compared to “hydrogen as fuel for carbon-free power,” a variation on an old theme, “hydrogen as opportunistic flexible load” is new. The time has come to recognize this potential flexibility and revise policies and regulations to foster and take advantage of it.

The need for cheap, clean electricity

Allowing electrolyzers access to the cheapest possible electricity for much of the year unlocks this flexibility. The economics of green hydrogen depend on three factors: capital costs, energy costs, and equipment utilization rates. The more often the electrolyzer accesses cheap electricity, the more price-responsive the electrolyzer can be, and the more it can produce hydrogen at a lower price. When electrolyzers like the ones being built in Utah can access diverse regional clean resources, it substantially benefits their financial bottom-line when compared to a single local solar or wind farm.

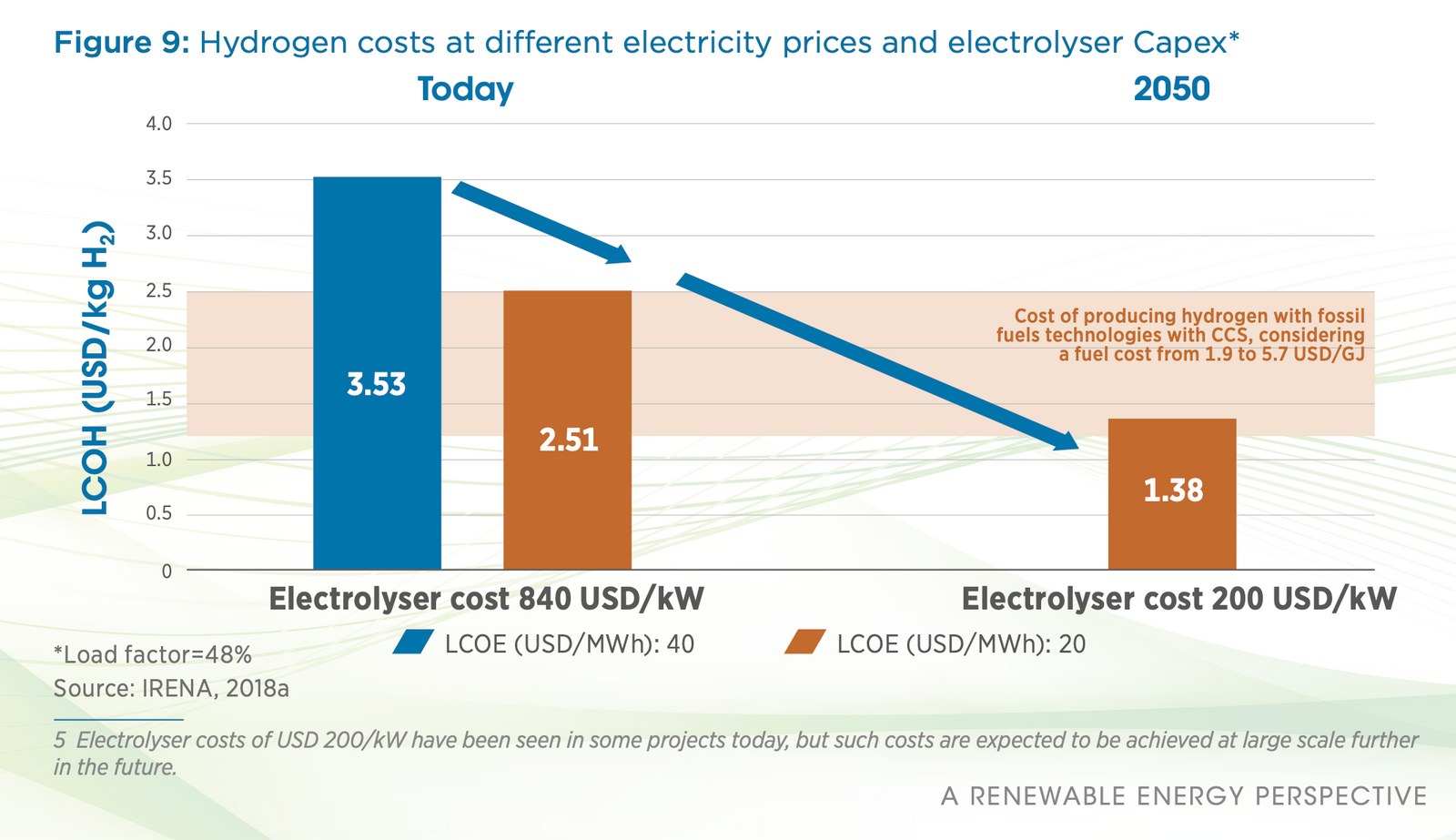

Permission granted by Energy Innovation

The International Renewable Energy Agency estimates today’s cost of green hydrogen range from $2.51 to $3.53 per kilogram (kg). These prices correspond to $20-28/mmBTU natural gas, so it only makes sense to burn hydrogen for power when there is a carbon constraint or grid conditions are very tight, when spot gas prices are comparable. For hydrogen as a feedstock, these prices are higher than fossil-derived hydrogen used today (< $1/kg) and uncompetitive absent a carbon price.

One way to decrease green hydrogen’s cost is increasing the electrolyzers’ load factor without driving up the cost of energy. Moving to an 80% load factor in the figure above would shave $.90/kg of the cost of green hydrogen. But this can only happen if electrolyzers can be flexible in when they consume electricity.

To have a maximum impact on the clean energy transition, the ACES project will need to demonstrate a hydrogen electrolyzer can leverage flexibility to balance the need for cheap energy and high utilization.

Three policy recommendations to unlock green hydrogen’s flexibility potential

Utilities and regulators can cost-effectively tap green hydrogen’s flexibility potential through three policy actions.

First, planning and siting should be optimized to get the most benefit out of green. For example, building out future hydrogen hubs should be coordinated with developing new regional renewable energy zones and new industries interested in green hydrogen as a feedstock.

Second, transactional friction should be reduced for green hydrogen. Hydrogen will be a commodity business dominated by electricity prices, so hydrogen needs access to low industrial rates. Regulators and utilities should design rates that incent electrolyzers to synchronize consumption with the real-time electricity costs and consider ways they can avoid burdensome transmission charges without unduly shifting costs.

Third, if or when the right conditions arise for large-scale green hydrogen production, planners should evaluate associated reliability opportunities. An integrated approach that utilizes state-of-the-art grid planning and incorporates the evolution of supply and demand dynamics from flexible green hydrogen hub electrolysis in capacity expansion projections to adjust resource adequacy criteria is one best practice.

Green hydrogen’s nascent possibilities are just now manifesting themselves across the U.S., but as plans unfold, policymakers should ensure it is deployed in a way that optimizes efficiency, affordability, and function to best support a reliable 100% clean grid.

Eric Gimon | https://www.utilitydive.com/