Beyond Investing: Biden’s bold plans for the future.

Beyond Investing is pleased to present this update on its US Vegan Climate Index in the wake of the recent US Presidential election.

With the results of the US presidential election called, it feels like a bright new dawn - certainly in terms of climate change. President-elect Biden has publicly, repeatedly demonstrated that he has policies lined up to reduce environmental damage, in contrast with his predecessor's climate change denial-based policy making.

Biden's dramatic announcement that he will reverse Trump's exit from the Paris Climate agreement – on the very day he takes office in January – will be a fitting backdrop to whatever comes after, and some pundits have even mooted the possibility of declaring a National Emergency on Climate – to rapidly reverse the longterm climate damage arising from former US policies.

Any re-orientation in the US's ailing climate change policies could lead to an upturn in the fortunes of many climate, animal-friendly and ESG-focused strategies.

Whilst viewing his presidency as a clear opportunity to push a more cruelty-free agenda, will governments be prepared to go as far as to cut subsidies on animal agriculture? Perhaps the best we can do is to examine and understand the possible outcomes of a Biden presidency through the lens of ESG.

Climate friendly politics

Widely considered a mainstream Democrat, Biden's centre-left views have seen him support several climate friendly bills, including carbon emissions cap and trade, mass transit and renewable energy subsidies. Most importantly, Biden is credited with introducing the first climate change bill – the 1986 Global Climate Protection Act in Congress.

Biden's presidential campaign included a US$1.7 trillion climate policy plan – described as the most ambitious climate platform of any presidential candidate in history - which aims to eliminate U.S. net greenhouse gas emissions by 2050. Under this plan, fossil fuel subsidies would be eliminated; there would be no new permits for oil and gas extraction on public land and water, plus a promise of more aggressive energy efficiency standards on buildings.

Furthermore, plans are afoot for enforcement of Clean Air Act measures - to increase fuel economy standards and promote a shift to electric vehicles – and perhaps most notably, to regulate methane emissions.

Regulating methane is a gentle political way of saying there will be new curbs on oil and gas production and animal agriculture. A more obvious hint at Biden's stance on rampant factory farming is his expected support of Senator Cory Booker's Farm System Reform Act (FSRA), a bill which aims to prevent new large-scale factory farms from opening - and hold the industry accountable for the pollution it creates.

Action to undo damage

Biden is also expected to rollback Trump's 2017 executive order which called on every federal agency to dismantle their climate policies.

While COVID-19 stimulus packages will clearly be high on the new President's agenda, analysts also predict these packages will include clean energy funding, support for expanding renewable energy plans, and further tax credits for renewable energy industries.

A lot of the campaign chatter concerned addressing the effects of pollution and global warming in low income communities. Biden may well create an environmental justice advisory board, bringing the spotlight onto pollution monitoring in poorer communities, for example.

As well as the Paris agreement, Biden could go ahead and sign an executive order requiring public companies to disclose climate change-related financial risks and greenhouse gas emissions in their operations.

Another first day pledge is to take “immediate steps to reverse the Trump assault on America’s national treasures” including major cuts to national monuments, and retracting the recent decision to allow oil exploration in parts of the Arctic National Wildlife Refuge. The mooted executive order will conserve 30 per cent of land and waters in the US by 2030.

Major challenges abound

Let's not sugar coat the new administration's Herculean tasks, though. Transitioning a massive resource and fossil-fuel dependent economy into a more climate-friendly one is an epic undertaking. It's likely he will need to change the structure of government through appointments and the creation of climate agencies. This might take considerable time – and money.

Chipping away at the more than 100 measures introduced under Trump's administration to demolish environmental regulation will be time consuming to say the least, and there's also the bureaucratic nightmare of halting Trump's fossil fuelfriendly projects.

Creating jobs is also a key tenet of the Biden presidency – and many of those may well come in the automotive and power sectors – but these sectors are sure to fall under the scrutiny of a President who understands and appreciates climate change, biodiversity and the need for long-reaching policies which aim to reduce human effect on climate.

Biden's sweeping – and urgently needed – plans for more environmentally sound legislation could yet be scuppered by the possibility of a Republican-controlled Senate. That said, the flurry of climate-forward executive actions on the drawing board are a clear, bold and positive step in the right direction.

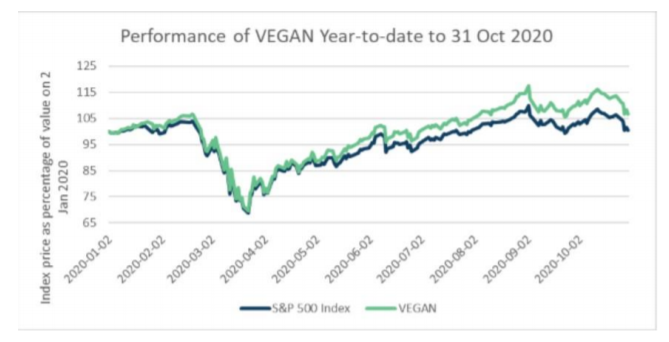

Much of VEGAN’s outperformance versus the S&P500 Index since its launch in June 2018 has accumulated over the course of this year, with 6.47% of the total 9.14% outperformance to date occurring through January till October 2020.

VEGAN has broadly mirrored the ups and downs of the S&P 500 Index benchmark, with over 98% correlation of returns, although its beta of 1.06 has led to a volatility some 1.4% higher than the market index.

An analysis of the year-to-date performance of VEGAN to end October 2020 shows how the differences in stock holdings between the VEGAN constituents and the market index have historically contributed to returns.

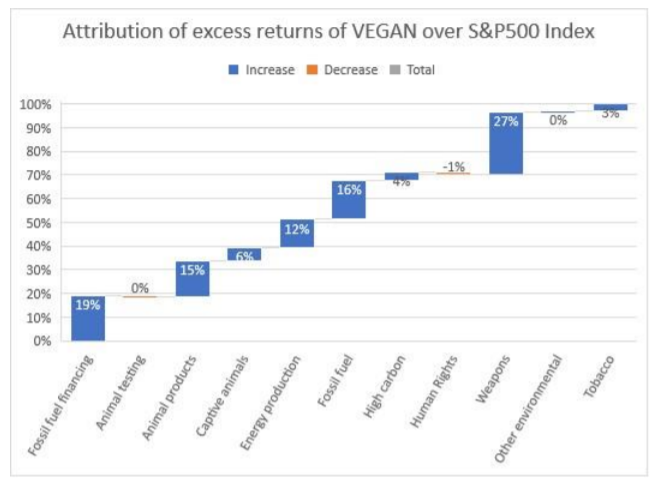

As the chart shows, the largest contribution came from avoiding stocks in the defense industry. Market commentators attribute their underperformance versus the market to fears that the ballooning deficit caused by pandemic stimulus packages will cause the government to make budget cuts elsewhere, and specifically to the defense budget.

Avoiding banks heavily involved in fossil fuel financing and oil and gas producers together led to about a quarter of net gains. The next largest source of performance were stocks VEGAN excluded by virtue of their sale of animal products. A portion of these stocks are involved in animal agriculture which is widely understood to be a significant contributor to greenhouse gases. Shunning high carbon stocks and utilities that are heavy users of fossil fuel made up 16% of the net gains. As such the US Vegan Climate Index is truly living up to its name - since the majority of its excess returns have been linked to an avoidance of exposures to companies whose activities harm animals and are directly responsible for the climate crisis.

It is not possible to predict returns. But the strong performance to date (despite the climate unfriendly policies, dedication to dirty fossil fuels and insistence on maintaining the pace of unsafe meat production of the current administration), sets a constructive precedent. With the new administration’s policies aimed at accelerating a transition away from these damaging industries, it would not be surprising were the weakness already seen in their share prices to exacerbate.

Thank you for reading this bulletin on the US Vegan Climate Index (ticker: VEGAN), which was launched in June 2018 by Beyond Investing, the world’s first and only vegan investment platform, to provide a cruelty-free and climate-friendly alternative to standard stock market indexes.

For more details please visit our site www.beyondinvesting.com, join our mailing list, and follow our social media channels indicated below for the latest news on animal-friendly and ethical investing

Follow On LinkedIn

Twitter: @BeyondInvest

Facebook:@beyondinvesting

30 November 2020

Climate Action